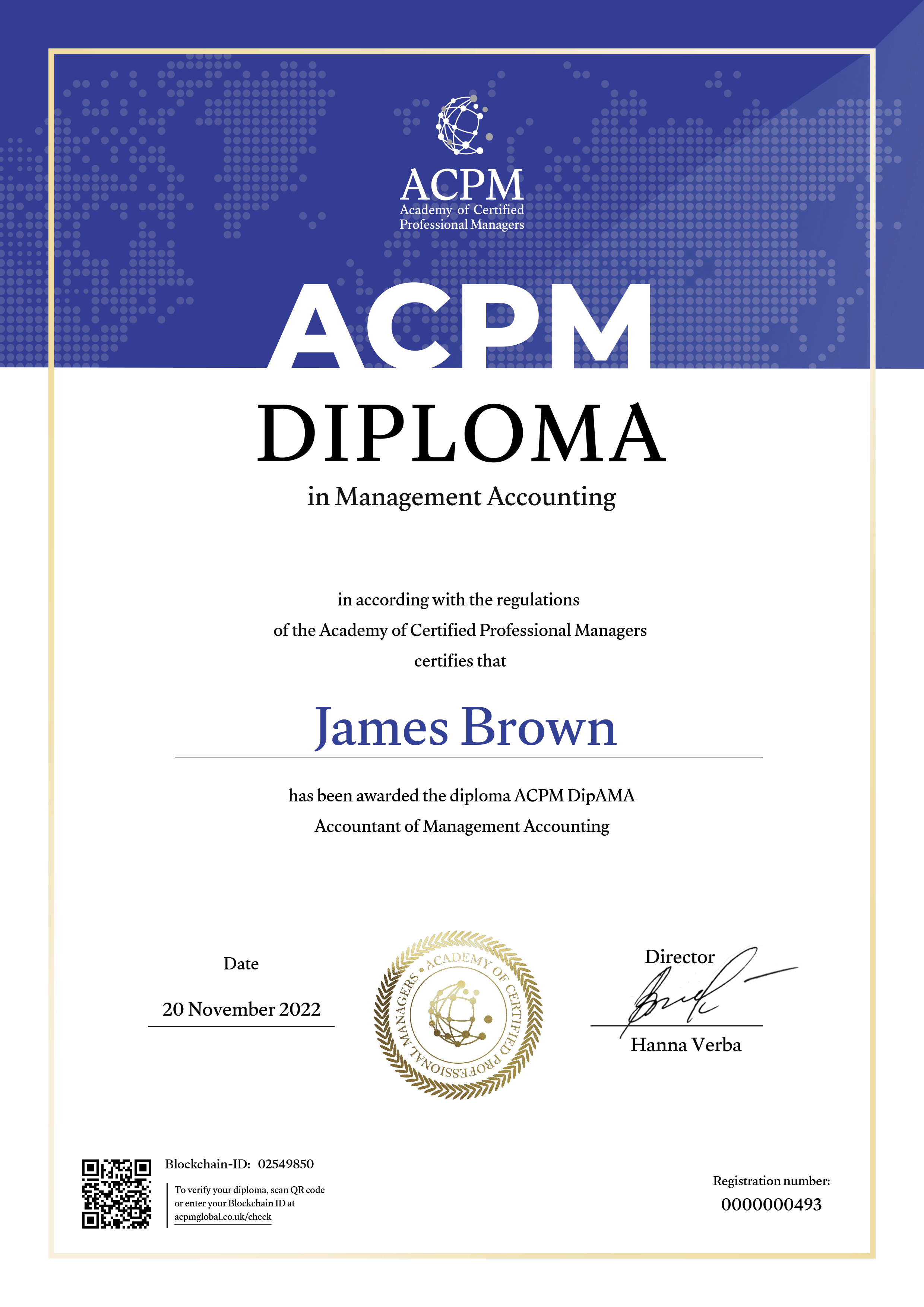

Accountant of Management Accounting

Accountant of Management Accounting

Modules

Topics

1.1. Nature of management accounting

- Definition of management accounting

- Fundamental differences between management and financial accounting

- Components of management accounting

- Essence of management accounting

- Objectives of management accounting

- Key users of management accounting

- Individuals responsible for establishing the management accounting system in an organization

- Tasks of management accounting

- Main components of the management accounting system in an organization

- Primary processes ensuring the formation and operation of the management accounting system

- Factors influencing the establishment of the management accounting system in organizations

1.2. Conceptual and methodological basis of finance reporting

- Definition of costs and methods of cost classification

- Cost categories: fixed, variable, average, marginal

- Other types of costs

- Models and methods of product costing

Topics

2.1 Budgeting

- The planning process in an enterprise

- Budgeting system

- Strategic, tactical, and operational planning

2.2. Intangible assets and asset impairment

- Forecasting. Key stages of forecasting

- Basic forecasting methods

- Sales forecasting

2.3. Financial reporting forecasting

- Forecasting financial statements

- Factors influencing the need for external financing

- Forecasting financial needs in the presence of fluctuating financial indicators for the company

Topics

3.1. Management analysis: profit maximization methods

- Cost structure analysis

- Analytical profit and loss statement with emphasis on marginal profit

- Break-even analysis of the enterprise

- Operating leverage effect

- Choosing the optimal product mix structure

Topics

4.1. Sources of business financing

- Internal and external sources of financing for organizational activities, factors of financial equilibrium. Concept, structure, and purpose of financial markets

- Financial institutions, their purpose, and tasks

- Types of short-term credits. Conditions of trade credit

- Minimizing the cost of short-term credit

- Securities as a tool for attracting financial resources

- Types of securities

- Methods of securities valuation

- Evaluation of bonds

- Evaluation of stocks

Topics

5.1. Working capital management

- Definitions, significance, and characteristics of working capital management. Operational and financial cycles

- Inventory management

- Accounts receivable management

- Cash management

- Working capital financing policy

Topics

6.1. Long-term financial decisions

- Definition of investments, types of investments. Nature of investment decisions. Time value of money concept. Annuities. Future and present value of annuity

- Methods of investment appraisal

- Consideration of inflation, taxation, risks, and uncertainty

Topics

7.1. Risk and return: basic concepts

- Interest rate risk and currency risk. Methods and tools for risk management

- Methods of financial risk neutralization

- Insurance, hedging, diversification

7.2. Cost of capital and capital structure decisions

- Cost of capital. Weighted average cost of capital

- Factors influencing the capital structure

- Corporate capital structure policy and the impact of capital structure on enterprise value

- Dividend policy

- Types of dividend policies

- Factors influencing the choice of dividend policy

- Dividend policy and stock price regulation

Topics

8.1. Measurement of business value for shareholders

- Concept of value and types of value. Creating value for shareholders. Methods for determining the value of an ongoing enterprise

- Cost approach valuation

- Income approach valuation

- Comparable sales approach

- Managing business through Shareholder Value Analysis (SVA)

- Economic Value Added (EVA). Comparing EVA and SVA

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.

Part 1. Professional Accountant (IFRS)

Nature of Management Accounting. Cost Classification for Decision Making

Topics

1.1. Nature of management accounting

- Definition of management accounting

- Fundamental differences between management and financial accounting

- Components of management accounting

- Essence of management accounting

- Objectives of management accounting

- Key users of management accounting

- Individuals responsible for establishing the management accounting system in an organization

- Tasks of management accounting

- Main components of the management accounting system in an organization

- Primary processes ensuring the formation and operation of the management accounting system

- Factors influencing the establishment of the management accounting system in organizations

1.2. Conceptual and methodological basis of finance reporting

- Definition of costs and methods of cost classification

- Cost categories: fixed, variable, average, marginal

- Other types of costs

- Models and methods of product costing

Module 2. Cost Management Concept. Methods of Costing. Cost-Volume-Profit Analysis. Break-Even Point

Topics

2.1 Cost management concept. Costing methods

- Segregation of costs into fixed and variable

- Costing of production costs

2.2. Cost-Volume-Profit analysis. Break-even point

- Essence of CVP analysis. Break-even analysis

- Companies with high fixed and variable costs

Module 3. Managerial Format of the Income Statement. Analysis of Sales Structure and Profitability of Individual Product Types

Topics

3.1. Managerial analysis: profit maximization methods. Managerial Income Statement format

- Income Statement for managerial decision-making. Possible options for constructing an Income Statement

- Algorithm for compiling an Income Statement for management accounting purposes

3.2. Analysis of sales structure and profitability of individual product types

- Sales analysis. ABC sales analysis

- XYZ sales analysis

- Analysis of sales profitability

- Factor analysis of sales profitability

Module 4. Pricing

Topics

4.1. Pricing

- Objectives of pricing

- Types of сosts

- Cost-based pricing methods

- Market-based pricing methods

- Conclusions on pricing methods

- Price elasticity of demand

- Parametric pricing methods

Module 5. Budgeting; Types of Budgets; Master Budget; Responsibility Centers

Topics

5.1. Budgeting, types of budgets, Master Budget

- Budget and types of budgets

- What is budgeting

- Factor analysis of cost by cost categories

5.2. Responsibility centers

- Essence of responsibility centers, their role, advantages, and disadvantages

- Financial responsibility centers and their key Indicators

- Cost center accounting

Module 6. Financial Control: Financial Performance Indicators. Financial Control Tools: Flexible Budget and Transfer Pricing

Topics

6.1. Financial control: financial performance indicators

- System of financial ratios

- Essence of responsibility centers, their role, advantages, and disadvantages

- Operational analysis indicators

- Operational cost indicators

- Efficiency indicators for asset management

- Liquidity indicators

- Profitability indicators

- Capital structure indicators

- Debt service indicators

- Market Indicators

6.2. Financial control tools: flexible budget and transfer pricing

- Flexible budgets and control

- Transfer pricing

- Essence, necessity, and objectives of transfer pricing

- Factors influencing the establishment of transfer prices

- Mechanism of transfer pricing based on market price

- Pricing based on market prices

- Types of pricing based on full and marginal costs

- Other types of transfer pricing

Module 7. Segment Reporting. Management Control: Non-Financial Performance Indicators

Topics

7.1. Segment reporting

- Role of segment reporting with a real example

- Procedure for forming segment management reporting

7.2. Management control: non-financial performance indicators

- Internal non-financial indicators

- External non-financial indicators

- Interconnection of financial and non-financial indicators

Module 8. Development of Management Control System: Balanced Scorecard

Topics

8.1. Development of management control system: Balanced Scorecard

- Objectives of developing the Balanced Scorecard (BSC)

- Components of the Balanced Scorecard

- Typical project for developing the Balanced Scorecard

- Utilizing financial analysis within the Balanced Scorecard framework

Module 9. The concluding assessment. Mock exam.

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.