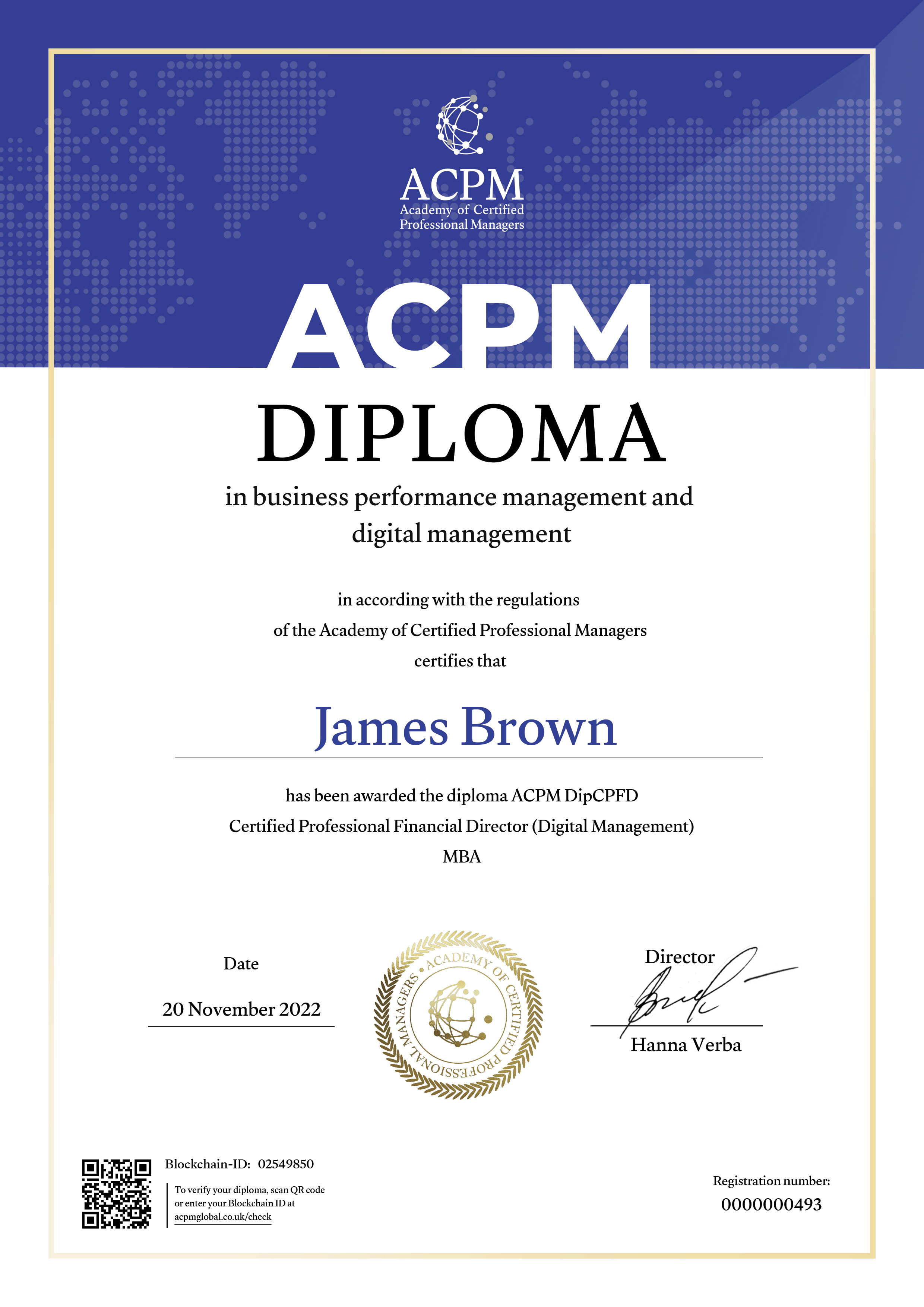

International programme

CP Financial Director Expert (FD3 МВА)

Expert in business performance management and digital management

Apply for the programmeCP Financial Director Expert (FD3 МВА)

Operations Performance Management

Modules

Topics

1.1. Cost behavior

- Cost dynamics model and levels of business activity

- Determination of fixed and variable components within conditionally variable costs

1.2. Full absorption costing and marginal costing methods

- Principles of the marginal costing method

- Principles of full absorption costing method

- Impact of marginal costing method and full absorption costing method on financial profit and inventory valuation

- Comparison of marginal costing method and full absorption costing method

- Overhead cost issue

1.3 Process costing method

- Foundations for developing a process costing system

- General description of the process costing system

- Comparison between the full absorption costing system and the process costing system

- Marginal costing method and process costing system

- Implementation of the process costing system

- Advantages and disadvantages of the process costing system

1.4 Standard costing method

- Utilization of standard costing

- Establishment of standards for the manufacturing sector

- Establishment of standards for the service sector

- Updating/revision of standards

- Budget and standard comparison

- Critique of the standard costing system

- Cost-effectiveness, performance, and efficiency

- Costing of digital products

- Digital cost calculation

Topics

2.1 Variance analysis

- Variances

- Material direct cost variances

- Direct labor cost variances

- Variable overhead cost variances

- Fixed overhead cost variances

- Sales variances

- Non-production cost variances

2.2 Interpretation of variances

- To investigate or not to investigate?

- Models for investigating variances

- General variances: the principle of controllability

- Interpretation of variances

- Utilization of production capacities coefficients

- Benchmarking

2.3 Budget vs. actual profit reconciliation

- Operational reports

- Variances in the standard costing system for variable costs

- Approach to analyzing and computing variances "backward"

- Variances in material costs by item and yield

- Variances in the structure of direct labor costs and labor output

- Sales variances by assortment (structure) and quantity of products sold

- Detailed analysis of fixed production overhead variances

- Analysis of variances using the process costing method

- Planned and operational variances

- Service sector variances

Topics

3.1 Budgeting

- Budget planning and control systems

- Compilation of budgets

- Sales budget

- Production and related budgets

- Cash budget and consolidated budget

- Monitoring procedures

- Incremental budgeting

3.2 Budgeting process

- Fixed and flexible budgets

- Preparation of flexible budgets

- Flexible budgets and budgetary control

- Using spreadsheets to build business models

- Budgeting as a control system

- Feedback mechanisms and proactive control

- Cost accounting by responsibility centers

3.3. Responsibility center accounting system

- Behavioral aspects in budgeting

- Participation in the budgeting process

- Using budgets as plans

- Budgets and motivation

Topics

4.1. Financial forecasting

- Forecasting

- Linear regression analysis

- Scatter plot and correlation

- Sales forecasting

- Regression and forecasting

- Components of time series

- Trend detection

- Detection of seasonal fluctuations

- Time series analysis and forecasting

- Using spreadsheets to build business models

- Forecasting challenges

Topics

5.1. Relevant information

- Relevant costs and revenues (revenue)

- Irrelevant costs and revenues

- Some rules for identifying relevant costs

- Assumptions in accounting for relevant costs

- Relationship to accounting concepts

- Qualitative factors in decision making

5.2. Short-term decision making

- Short-term decisions

- Contract acceptance/rejection

- Setting a minimum price

- Decisions regarding additional shifts and overtime

- "Make or buy" decisions

- Either/or decisions

- Business closure issues

- Choosing between alternatives

- Allocation of common costs

Topics

6.1 Break-even analysis

- Break-even analysis for a single product

- Break-even analysis in the production of multiple products

- Contribution-to-Sales (C/S) ratio for multiple products

- Decisions on sales structure or product assortment

- Planned profit indicators for multiple products

- Safety margin in the production of multiple products

- Break-even charts for multiple products

- Further aspects of break-even analysis

- Sensitivity analysis

Topics

7.1 Constraint analysis

- Overview of limiting factors

- Analysis of limiting factors with limited freedom of action

- "Make or buy" decisions with limited resources

- Utilizing constraint analysis

7.2 Linear programming: graphical method

- Graphical method

- Graphical method using a system of equations

- Sensitivity analysis

Topics

8.1. Risk Analysis

- Risk propensity

- Maximin, maximax, and minimax loss criteria for decision making

- Decision tree

- Value of information

- Sensitivity analysis

- Simulation modeling

Business Performance Management

Modules

Topics

1.1. System of process management

- Nature of costs

- Process costing

- Activity-based management

- Direct product profitability

- Customer profitability analysis (CPA)

- Distribution channel profitability

- Profitability analysis by types of activities

1.2. Total quality management (TQM) methods

- Conditions for the formation of traditional and modern methods

- Just-in-Time (JIT) management concept

- Theory of Constraints (TOC)

- Process productivity accounting (TA)

- Cost management by kaizen method

- Continuous improvement

- Total Quality Management (TQM)

- Quality assurance costs and quality cost reports

- Business Process Reengineering (BPR)

- World Class Manufacturing (WCM)

Topics

2.1 Methods for increasing long-term profit

- Life cycle cost accounting

- Target costing

- Cost analysis

- Functional analysis

- Quality Function Deployment (QFD)

2.2. Value creation chain

- Value creation chain

- Supply chain management

- Outsourcing

- Partnership, material incentives, and joint participation in profits

Topics

3.1 Decision making in responsibility centers

- Responsibility centers

- Behavioral aspects in budgeting

- Participation in the budgeting process

- Using budgets as plans

- Budgets and motivation

3.2 Budgetary control

- Financial performance indicators

- Return on Equity (ROE)

- Return on Investment (ROI) in decision-making

- Residual Income (RI)

- Economic Value Added (EVA)

3.3 Performance indicators

- Imperfections of financial performance indicators

- Non-financial performance indicators

- Benchmarking

- Balanced Scorecard

- Non-profit organizations. Non-budgetary management

Topics

4.1 Pricing strategies

- Demand

- Other factors influencing pricing decisions

- Derivation of the demand curve

- Price maximizing profit/production level

- Pricing using the "full cost plus" method

- Pricing using the "marginal cost plus" method (markup method)

- Pricing based on markup on the unit of the limiting factor

- Pricing strategies for new products

- Pricing strategies based on market approach

- Product life cycle

- Price/quality ratio

- Marketing

- Income elasticity of demand

- Ethical considerations

Topics

5.1 Transfer pricing systems

- Basic principles of transfer pricing

- General rules

- Using market price as the basis for transfer pricing

- Transfer pricing in an imperfect external market

- Transfer pricing in the absence of an external market for transferred goods

- Transfer pricing and changes in costs/prices

- Determining the optimal transfer price

- Contractual transfer prices

- International transfer pricing

Topics

6.1 Investment decision-making process

- Investment decision-making process

- Post-completion audit (PCA)

- Payback period method

- Accounting Rate of Return (ARR)

6.2 Discounting cash flows in investment evaluation

- Net Present Value (NPV) method

- Internal Rate of Return (IRR) method

- Comparative analysis of NPV and IRR

- Discounted payback period

- DCF: additional aspects

6.3 Impact of taxes and inflation on investment decisions

- Impact of inflation

- Tax considerations

Topics

7.1 Mutually exclusive projects. Capital rationing

- Mutually exclusive projects with different implementation periods

- Asset substitution

- Capital rationing

- Project termination

- Sensitivity analysis

- Probabilistic analysis in long-term decision making

Topics

8.1 Management control and risks

- Key principles

- Two-dimensional outcome tables

- Risk attitude

- Decision tree. Multi-stage problem-solving

- Sensitivity analysis

- Conditional probabilities – Bayes' Theorem

- Perfect and imperfect information

- Utility theory

Topics

9.1 Risk management

- Key principles

- Risk management strategy

- Risk management – TARA model

- Risk map

- Stress testing

- Ethical issues as sources of risk

- Social responsibility

9.2 Gathering and using information

- Information systems and their role in management

- Risks

- Risks and benefits of using the internet and intranet

- Value and cost of information

- Big Data (large datasets)

Crisis Management

Modules

Topics

External crises. Crises in examples.

Ishikawa diagram

Topics

Internal crises.

Adizes Test

Topics

Factors influencing company resilience in a crisis:

Inventory management.

Investment and financial activities.

Motivational system.

Topics

Strategic decisions in crisis conditions.

Strategic analysis.

Risks of new economic conditions.

Major mistakes.

Part 1. Operations Performance Management

Cost Behavior. Full Absorption Costing and Marginal Costing Methods. Process Costing Method. Standard Costing Method

Topics

1.1. Cost behavior

- Cost dynamics model and levels of business activity

- Determination of fixed and variable components within conditionally variable costs

1.2. Full absorption costing and marginal costing methods

- Principles of the marginal costing method

- Principles of full absorption costing method

- Impact of marginal costing method and full absorption costing method on financial profit and inventory valuation

- Comparison of marginal costing method and full absorption costing method

- Overhead cost issue

1.3 Process costing method

- Foundations for developing a process costing system

- General description of the process costing system

- Comparison between the full absorption costing system and the process costing system

- Marginal costing method and process costing system

- Implementation of the process costing system

- Advantages and disadvantages of the process costing system

1.4 Standard costing method

- Utilization of standard costing

- Establishment of standards for the manufacturing sector

- Establishment of standards for the service sector

- Updating/revision of standards

- Budget and standard comparison

- Critique of the standard costing system

- Cost-effectiveness, performance, and efficiency

- Costing of digital products

- Digital cost calculation

Module 2. Variance Analysis. Interpretation of Variances. Budget vs. Actual Profit Reconciliation

Topics

2.1 Variance analysis

- Variances

- Material direct cost variances

- Direct labor cost variances

- Variable overhead cost variances

- Fixed overhead cost variances

- Sales variances

- Non-production cost variances

2.2 Interpretation of variances

- To investigate or not to investigate?

- Models for investigating variances

- General variances: the principle of controllability

- Interpretation of variances

- Utilization of production capacities coefficients

- Benchmarking

2.3 Budget vs. actual profit reconciliation

- Operational reports

- Variances in the standard costing system for variable costs

- Approach to analyzing and computing variances "backward"

- Variances in material costs by item and yield

- Variances in the structure of direct labor costs and labor output

- Sales variances by assortment (structure) and quantity of products sold

- Detailed analysis of fixed production overhead variances

- Analysis of variances using the process costing method

- Planned and operational variances

- Service sector variances

Module 3. Budgeting. Budgeting Process. Behavioral Aspects in Budgeting

Topics

3.1 Budgeting

- Budget planning and control systems

- Compilation of budgets

- Sales budget

- Production and related budgets

- Cash budget and consolidated budget

- Monitoring procedures

- Incremental budgeting

3.2 Budgeting process

- Fixed and flexible budgets

- Preparation of flexible budgets

- Flexible budgets and budgetary control

- Using spreadsheets to build business models

- Budgeting as a control system

- Feedback mechanisms and proactive control

- Cost accounting by responsibility centers

3.3. Responsibility center accounting system

- Behavioral aspects in budgeting

- Participation in the budgeting process

- Using budgets as plans

- Budgets and motivation

Module 4. Financial Forecasting

Topics

4.1 Pricing strategies

- Demand

- Other factors influencing pricing decisions

- Derivation of the demand curve

- Price maximizing profit/production level

- Pricing using the "full cost plus" method

- Pricing using the "marginal cost plus" method (markup method)

- Pricing based on markup on the unit of the limiting factor

- Pricing strategies for new products

- Pricing strategies based on market approach

- Product life cycle

- Price/quality ratio

- Marketing

- Income elasticity of demand

- Ethical considerations

Module 5. Relevant Information. Short-Term Decision Making

Topics

5.1. Relevant information

- Relevant costs and revenues (revenue)

- Irrelevant costs and revenues

- Some rules for identifying relevant costs

- Assumptions in accounting for relevant costs

- Relationship to accounting concepts

- Qualitative factors in decision making

5.2. Short-term decision making

- Short-term decisions

- Contract acceptance/rejection

- Setting a minimum price

- Decisions regarding additional shifts and overtime

- "Make or buy" decisions

- Either/or decisions

- Business closure issues

- Choosing between alternatives

- Allocation of common costs

Module 6. Break-Even Analysis

Topics

6.1 Investment decision-making process

- Investment decision-making process

- Post-completion audit (PCA)

- Payback period method

- Accounting Rate of Return (ARR)

6.2 Discounting cash flows in investment evaluation

- Net Present Value (NPV) method

- Internal Rate of Return (IRR) method

- Comparative analysis of NPV and IRR

- Discounted payback period

- DCF: additional aspects

6.3 Impact of taxes and inflation on investment decisions

- Impact of inflation

- Tax considerations

Module 7. Sonstraint Analysis. Linear Programming: Graphical Method

Topics

7.1 Mutually exclusive projects. Capital rationing

- Mutually exclusive projects with different implementation periods

- Asset substitution

- Capital rationing

- Project termination

- Sensitivity analysis

- Probabilistic analysis in long-term decision making

Module 8. Risk Analysis

Topics

8.1 Management control and risks

- Key principles

- Two-dimensional outcome tables

- Risk attitude

- Decision tree. Multi-stage problem-solving

- Sensitivity analysis

- Conditional probabilities – Bayes' Theorem

- Perfect and imperfect information

- Utility theory

Part 2. Business Performance Management

Module 1. System of Process Management. Total Quality Management (TQM) Methods

Topics

1.1. System of process management

- Nature of costs

- Process costing

- Activity-based management

- Direct product profitability

- Customer profitability analysis (CPA)

- Distribution channel profitability

- Profitability analysis by types of activities

1.2. Total quality management (TQM) methods

- Conditions for the formation of traditional and modern methods

- Just-in-Time (JIT) management concept

- Theory of Constraints (TOC)

- Process productivity accounting (TA)

- Cost management by kaizen method

- Continuous improvement

- Total Quality Management (TQM)

- Quality assurance costs and quality cost reports

- Business Process Reengineering (BPR)

- World Class Manufacturing (WCM)

Module 2. Methods for Increasing Long-Term Profit. Value Creation Chain

Topics

2.1 Variance analysis

2.1 Methods for increasing long-term profit

- Life cycle cost accounting

- Target costing

- Cost analysis

- Functional analysis

- Quality Function Deployment (QFD)

2.2. Value creation chain

- Value creation chain

- Supply chain management

- Outsourcing

- Partnership, material incentives, and joint participation in profits

Module 3. Decision Making in Responsibility Centers. Budgetary Control. Performance Indicators

Topics

3.1 Decision making in responsibility centers

- Responsibility centers

- Behavioral aspects in budgeting

- Participation in the budgeting process

- Using budgets as plans

- Budgets and motivation

3.2 Budgetary control

- Financial performance indicators

- Return on Equity (ROE)

- Return on Investment (ROI) in decision-making

- Residual Income (RI)

- Economic Value Added (EVA)

3.3 Performance indicators

- Imperfections of financial performance indicators

- Non-financial performance indicators

- Benchmarking

- Balanced Scorecard

- Non-profit organizations. Non-budgetary management

Module 4. Pricing Strategies

Topics

4.1 Pricing strategies

- Demand

- Other factors influencing pricing decisions

- Derivation of the demand curve

- Price maximizing profit/production level

- Pricing using the "full cost plus" method

- Pricing using the "marginal cost plus" method (markup method)

- Pricing based on markup on the unit of the limiting factor

- Pricing strategies for new products

- Pricing strategies based on market approach

- Product life cycle

- Price/quality ratio

- Marketing

- Income elasticity of demand

- Ethical considerations

Module 5. Transfer Pricing Systems

Topics

5.1 Transfer pricing systems

- Basic principles of transfer pricing

- General rules

- Using market price as the basis for transfer pricing

- Transfer pricing in an imperfect external market

- Transfer pricing in the absence of an external market for transferred goods

- Transfer pricing and changes in costs/prices

- Determining the optimal transfer price

- Contractual transfer prices

- International transfer pricing

Module 6. Investment Decision-Making Process. Discounting Cash Flows in Investment Evaluation. Impact of Taxes and Inflation on Investment Decisions

Topics

6.1 Investment decision-making process

- Investment decision-making process

- Post-completion audit (PCA)

- Payback period method

- Accounting Rate of Return (ARR)

6.2 Discounting cash flows in investment evaluation

- Net Present Value (NPV) method

- Internal Rate of Return (IRR) method

- Comparative analysis of NPV and IRR

- Discounted payback period

- DCF: additional aspects

6.3 Impact of taxes and inflation on investment decisions

- Impact of inflation

- Tax considerations

Module 7. Mutually Exclusive Projects. Capital Rationing

Topics

7.1 Mutually exclusive projects. Capital rationing

- Mutually exclusive projects with different implementation periods

- Asset substitution

- Capital rationing

- Project termination

- Sensitivity analysis

- Probabilistic analysis in long-term decision making

Module 8. Management Control and Risks

Topics

8.1 Management control and risks

- Key principles

- Two-dimensional outcome tables

- Risk attitude

- Decision tree. Multi-stage problem-solving

- Sensitivity analysis

- Conditional probabilities – Bayes' Theorem

- Perfect and imperfect information

- Utility theory

Module 9. Risk Management. Gathering and Using Information

Topics

9.1 Risk management

- Key principles

- Risk management strategy

- Risk management – TARA model

- Risk map

- Stress testing

- Ethical issues as sources of risk

- Social responsibility

9.2 Gathering and using information

- Information systems and their role in management

- Risks

- Risks and benefits of using the internet and intranet

- Value and cost of information

- Big Data (large datasets)

Crisis Management

Session 1

Topics

External crises. Crises in examples.

Ishikawa diagram

Session 2

Topics

Internal crises.

Adizes Test

Session 3

Topics

Factors influencing company resilience in a crisis:

Inventory management.

Investment and financial activities.

Motivational system.

Session 4

Topics

Strategic decisions in crisis conditions.

Strategic analysis.

Risks of new economic conditions.

Major mistakes.