International programme

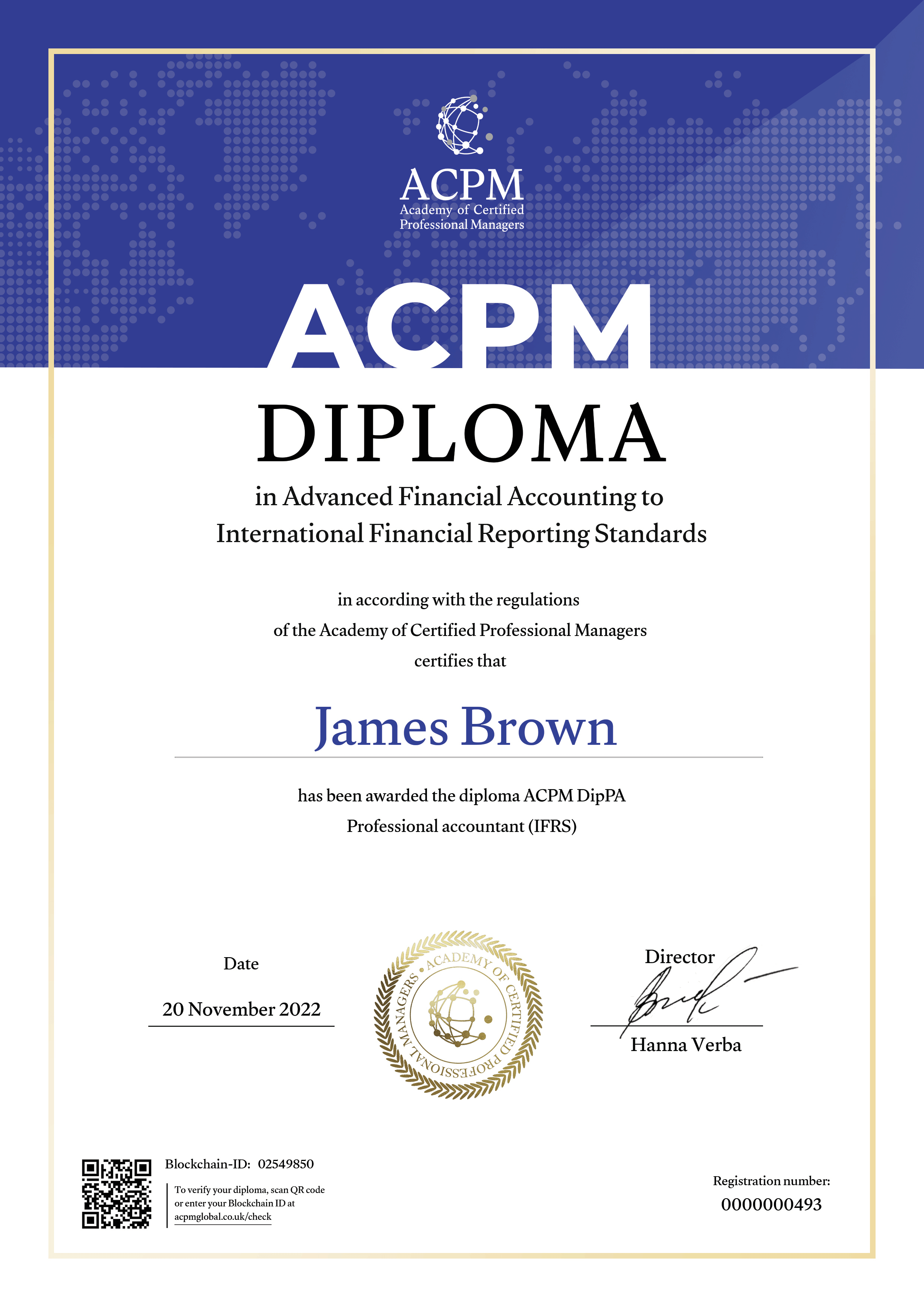

Professional Accountant (IFRS)

Advanced Financial Accounting to International Financial Reporting Standards (IFRS).

Apply for the programmeProfessional Accountant (IFRS)

Professional Accountant (IFRS)

Modules

Topics

1.1. Objectives, composition, and content of financial statements under IFRS

- Purpose of financial statements

- Composition of financial statements:

- Contents of financial statements (practice)

— IAS 1 Presentation of Financial Statements

1.2. Conceptual and methodological basis of finance reporting

- Principles of preparing financial statements

- Qualitative characteristics of reporting

1.3. Types of measurements. Discounted value

- Types of measurements

- Discounted value:

- Interest and Future Value

- Present (Discounted) Value

- Annuities

— IFRS 13 Fair Value Measurement.

1.4. Development of the company's accounting policy

- Key requirements for the accounting policy:

— IAS 8 (IFRS) Accounting Policies, Changes in Accounting

Estimates and Errors.

- Changes in accounting policy and changes in estimates

- Recognition of errors and methods of their correction

Topics

2.1 Long-Term tangible assets

- Property, plant, and equipment:

- Investment property:

- — IAS 40 Investment Property.

— IAS 16 Property, Plant and Equipment.

2.2. Intangible assets and asset impairment

- Intangible assets, types:

- Assessment after recognition

- Useful life

- Asset impairment:

- Recognition and measurement of losses

- Goodwill

— IAS 38 Intangible Assets.

— IAS 36 Impairment of Assets.

Topics

3.1. Current assets

- Inventories —

- Inventory impairment

- Methods of cost assessment

- Recognition as expenses

— IAS 2 Inventories

3.2. Non-current assets held for sale and discontinued operations

- Recognition criteria, initial and subsequent evaluation

- Presentation in financial statements

— IFRS 5 Non-current Assets Held for Sale and Discontinued Operations

3.3. Provisions, contingent liabilities

- Definition, recognition criteria, initial and subsequent assessment

- Contingent liabilities

— IAS 37 Provisions, Contingent Liabilities and Contingent Assets

Topics

4.1. Financial instruments

- Recognition and measurement of financial assets and financial liabilities

- Disclosure and presentation of information

— IFRS 9 Financial Instruments

— IAS 32 Financial Instruments: Presentation

— IFRS 7 Financial Instruments: Disclosures

4.2. Leases

- Principles of recognition, measurement, presentation, and disclosure

- Accounting for the Right-of-Use asset and lease liability in lessee's financial statements

- Accounting for sale and leaseback in lessee's financial statements

- Accounting for leases in lessor's financial statements

— IFRS 16 Leases

Topics

5.1. Recognition of revenues and expenses

- Principles of reporting revenue and cash flows from contracts with customers

- Five-step model for revenue recognition

- Costs related to contracts

— IFRS 15 Revenue from Contracts with Customers

5.2. Statement of cash flows

- Requirements and definitions

- Cash and cash equivalents

- Presentation of the statement of cash flows

- Operating, investing, and financing activities

— IAS 7 Statement of Cash Flows

Topics

6.1. Forms of investments in other companies

- Investments in associates and joint ventures

- Joint operations

— IAS 28 Investments in Associates and Joint Ventures

— IFRS 11 Joint Arrangements

6.2. Business combinations and consolidated financial statements

- Business combinations

- Consolidated financial statements

- Disclosure of information

— IFRS 3 Business Combinations

— IFRS 10 Consolidated Financial Statements

— IFRS 12 Disclosure of Interests in Other Entities

Topics

7.1. (IAS) 21 The Effects of Changes in Foreign Exchange Rates

- Reflecting transactions in foreign currencies in the functional currency

- Accounting for transactions and balances denominated in foreign currencies

7.2. (IAS) 23 Borrowing Costs

- Recognition and commencement of capitalization

- Suspension and cessation of capitalization

- Disclosure requirements

7.3. (IAS) 24 Related Party Disclosures

- Scope of application

- Groups of companies

- Related party

- Disclosure requirements

7.4. Other special topics

- (IAS) 24 Interim Financial Reporting

- (IFRS) 1 First-time Adoption of International Financial Reporting Standards

Topics

8.1. Other aspects of financial reporting and financial accounting

- (IAS) 10 Events After the Reporting Period

- (IAS) 12 Income Taxes

- (IAS) 20 Accounting for Government Grants and Disclosure of Government Assistance

8.2. Industry-specific financial reporting standards

- (IAS) 41 Agriculture

- (IFRS) 4 Insurance Contracts

- (IFRS) 6 Exploration for and Evaluation of Mineral Resources

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.

Professional Accountant (IFRS)

Modules 1. Introduction - (IAS) 1, (IFRS) 13, (IAS) 8

Topics

1.1. Objectives, composition, and content of financial statements under IFRS

- Purpose of financial statements

- Composition of financial statements:

- Contents of financial statements (practice)

— IAS 1 Presentation of Financial Statements

1.2. Conceptual and methodological basis of finance reporting

- Principles of preparing financial statements

- Qualitative characteristics of reporting

1.3. Types of measurements. Discounted value

- Types of measurements

- Discounted value:

- Interest and Future Value

- Present (Discounted) Value

- Annuities

— IFRS 13 Fair Value Measurement.

1.4. Development of the company's accounting policy

- Key requirements for the accounting policy:

— IAS 8 (IFRS) Accounting Policies, Changes in Accounting

Estimates and Errors.

- Changes in accounting policy and changes in estimates

- Recognition of errors and methods of their correction

Module 2. Assets - (IAS) 16, (IAS) 40, (IAS) 38, (IAS) 36

Topics

2.1 Long-Term tangible assets

- Property, plant, and equipment:

- Investment property:

— IAS 16 Property, Plant and Equipment.

— IAS 40 Investment Property.

2.2. Intangible assets and asset impairment

- Intangible assets, types:

- Assessment after recognition

- Useful life

- Asset impairment:

- Recognition and measurement of losses

- Goodwill

— IAS 38 Intangible Assets.

— IAS 36 Impairment of Assets.

Module 3. Assets - (IAS) 2, (IFRS) 5, (IAS) 37

Topics

3.1. Current assets

- Inventories —

- Inventory impairment

- Methods of cost assessment

- Recognition as expenses

— IAS 2 Inventories

3.2. Non-current assets held for sale and discontinued operations

- Recognition criteria, initial and subsequent evaluation

- Presentation in financial statements

— IFRS 5 Non-current Assets Held for Sale and Discontinued Operations

3.3. Provisions, contingent liabilities

- Definition, recognition criteria, initial and subsequent assessment

- Contingent liabilities

— IAS 37 Provisions, Contingent Liabilities and Contingent Assets

Module 4. Financial instruments. Leases - (IFRS) 9, (IAS) 32, (IFRS) 7, (IFRS) 16

Topics

4.1. Financial instruments

- Recognition and measurement of financial assets and financial liabilities

- Disclosure and presentation of information

— IFRS 9 Financial Instruments

— IAS 32 Financial Instruments: Presentation

— IFRS 7 Financial Instruments: Disclosures

4.2. Leases

- Principles of recognition, measurement, presentation, and disclosure

- Accounting for the Right-of-Use asset and lease liability in lessee's financial statements

- Accounting for sale and leaseback in lessee's financial statements

- Accounting for leases in lessor's financial statements

— IFRS 16 Leases

Module 5. Recognition of revenues and expenses. Statement of Cash Flows - (IFRS) 15, (IAS) 7

Topics

5.1. Recognition of revenues and expenses

- Principles of reporting revenue and cash flows from contracts with customers

- Five-step model for revenue recognition

- Costs related to contracts

— IFRS 15 Revenue from Contracts with Customers

5.2. Statement of cash flows

- Requirements and definitions

- Cash and cash equivalents

- Presentation of the statement of cash flows

- Operating, investing, and financing activities

— IAS 7 Statement of Cash Flows

Module 6. Forms of investments in other companies. Business Combinations and Consolidated Financial Statements - (IAS) 28, (IFRS) 11, (IFRS) 3, (IFRS) 10, (IFRS) 12

Topics

6.1. Forms of investments in other companies

- Investments in associates and joint ventures

- Joint operations

— IAS 28 Investments in Associates and Joint Ventures

— IFRS 11 Joint Arrangements

6.2. Business combinations and consolidated financial statements

- Business combinations

- Consolidated financial statements

- Disclosure of information

— IFRS 3 Business Combinations

— IFRS 10 Consolidated Financial Statements

— IFRS 12 Disclosure of Interests in Other Entities

Module 7. Special Topics in Financial Reporting - (IAS) 21, (IAS) 23, (IAS) 24, (IAS) 24, (IFRS) 1

Topics

7.1. (IAS) 21 The Effects of Changes in Foreign Exchange Rates

- Reflecting transactions in foreign currencies in the functional currency

- Accounting for transactions and balances denominated in foreign currencies

7.2. (IAS) 23 Borrowing Costs

- Recognition and commencement of capitalization

- Suspension and cessation of capitalization

- Disclosure requirements

7.3. (IAS) 24 Related Party Disclosures

- Scope of application

- Groups of companies

- Related party

- Disclosure requirements

7.4. Other special topics

- (IAS) 24 Interim Financial Reporting

- (IFRS) 1 First-time Adoption of International Financial Reporting Standards

Module 8. Other Aspects of Financial Reporting. Industry Standards - (IAS) 10, (IAS) 12, (IAS) 20, (IAS) 41, (IFRS) 4, (IFRS) 6

Topics

8.1. Other aspects of financial reporting and financial accounting

- (IAS) 10 Events After the Reporting Period

- (IAS) 12 Income Taxes

- (IAS) 20 Accounting for Government Grants and Disclosure of Government Assistance

8.2. Industry-specific financial reporting standards

- (IAS) 41 Agriculture

- (IFRS) 4 Insurance Contracts

- (IFRS) 6 Exploration for and Evaluation of Mineral Resources

Module 9. The concluding assessment. Mock exam.

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.