Professional financial director (FD1)

The certification program "ACPM: Professional financial director" is suitable for those who want to cover a wide range of professional knowledge in finance and become a certified CFO at an international level.

The program covers three important areas: IFRS, management accounting, and internal audit. Prepares competent financial specialists capable of guiding companies to sustainable success.

Apply for the programmeRequirements for candidates

The certification program provides advanced training. Therefore, basic knowledge of accounting and finance is necessary for its completion.

Training program

Key topics

- Goals, content, conceptual and methodological basis of financial reporting with IFRS.

- Types of assessments. Discounted value.

- Formation of the accounting policy of the company.

- Assets. Reserves, contingent liabilities.

- Financial instruments. Rent.

- Recognition of income and expenses. Statement of Cash Flows.

- Forms of investments in other companies. Mergers and consolidated financial statements.

- Special topics of financial reporting.

- Industry standards of financial reporting.

Skills

- Understanding the structure, key definitions, and concepts of IFRS. Content and components of financial reporting.

- Possession of theoretical data, which are used while preparing financial statements by IFRS.

- Solving practical problems. Ability to make calculations for the purpose of IFRS and show them in financial statements.

- Submission of financial statements and disclosure of additional information.

Key topics

- The nature of management accounting. Classification of costs for decision-making.

- Cost management concept. Cost calculation methods. Break-even point.

- Managerial format of the profit and loss statement.

- Cost-based pricing.

- Budgeting. Responsibility centers.

- Financial control and its tools.

- Segment reporting. Management control.

- Development of the management control system: a balanced system of activity indicators.

Skills

- Setting up a management accounting and budgeting system.

- Management of financial resources and costs.

- Application of cost accounting methods, cost calculation, and pricing for management decision-making.

- Understanding the goals and tasks of budgeting in the company.

- Development of the company's financial structure and budget model.

- Formation, optimization, and control of the company's financial results.

Key topics

- Concept of an internal control system.

- Regulation of internal audit.

- Toolkit of the internal auditor.

- Audit evidence.

- Identification and management of risks in the internal audit system.

- Stages of internal audit.

- Fraud.

Skills

- Understanding the basics of internal audit.

- Application of internal audit standards and tools.

- Implementation of an effective system of internal control of the company.

- Creating an internal audit plan and program.

- Conducting inspections. Formation of the audit report.

Skills after completing the program

After completing the "ACPM: Professional financial director" program, the candidate has the following knowledge and skills:

- Orientation in the requirements of international standards. Free use of IFRS terminology.

- Performing calculations for the purposes of IFRS and reflecting them in financial statements.

- Submission of financial statements and disclosure of additional information.

- Application of internal audit tools to protect the company from risks.

- Implementation of an effective system of internal control of the company.

- Conducting internal audits and generating reports.

- Optimization of risk management, control, and corporate management processes.

- Creation of a management accounting and budgeting system.

- Management of the company's financial resources and expenses.

- Development of the company's financial structure and budget model.

- Formation, optimization, and control of the company's financial results.

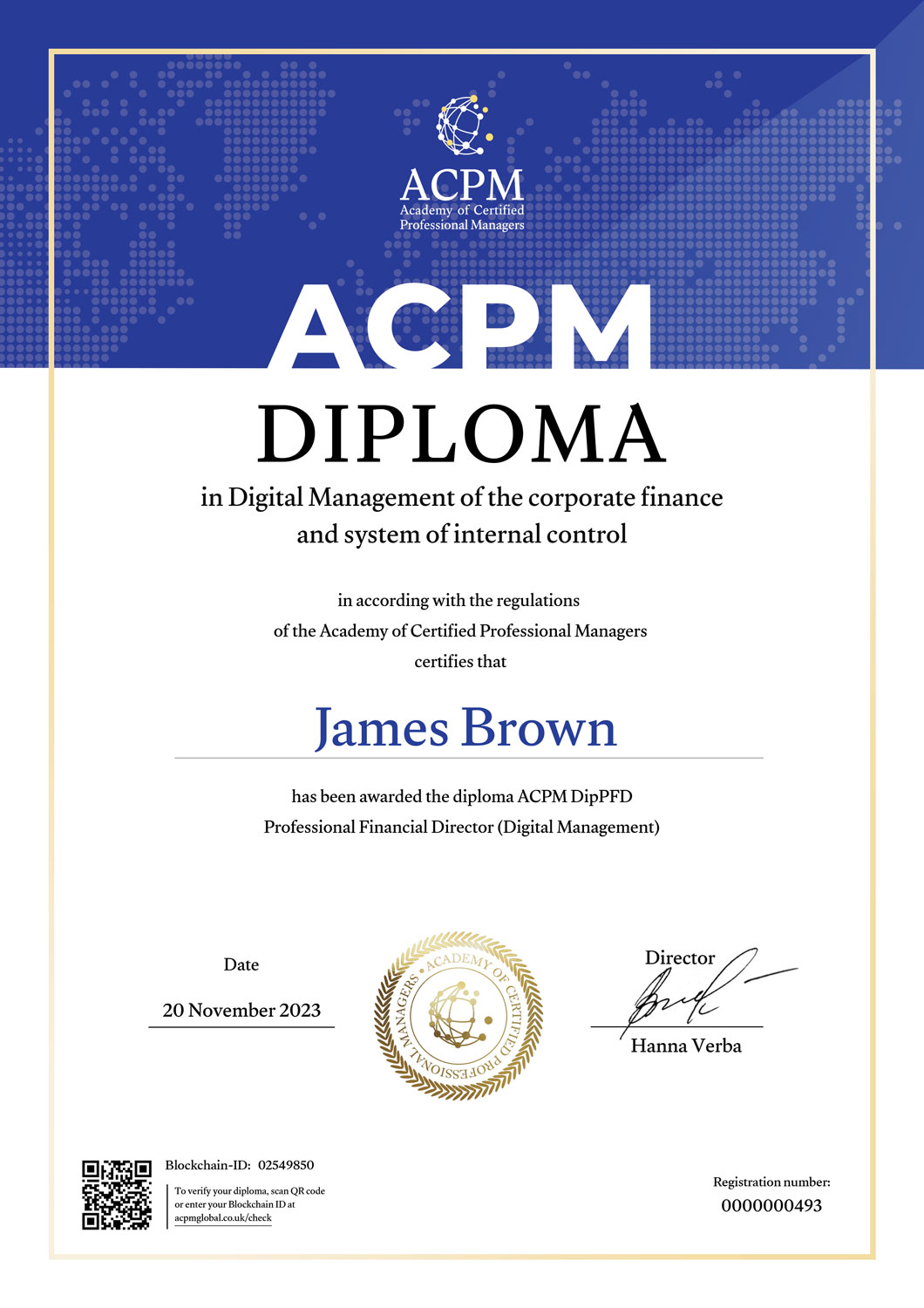

Exam and diploma

Knowledge is tested by three online exams for each part of the program: "ACPM: IFRS", "ACPM: Management accounting" and "ACPM: Internal audit". Exams are held every month according to the schedule. Registration is required to participate in each exam.

The exam consists of a test and a practical part (except "ACPM: Internal audit"). The total duration of the exam is from 2 to 3.5 hours (depending on the program).

The passing score is 60 (maximum score - 100 points).

The exam is conducted by administrators, and the completed assignments are checked and graded by ACPM-accredited instructors.

Each exam result is sent by email after 2-3 weeks. If a passing score is 60 or above, the ACPM International Diploma is sent electronically with the results.

After receiving diplomas in the IFRS, Management accounting, and Internal audit programs, the candidate automatically receives the diploma of a professional financial director "ACPM: Professional financial director".

Request the syllabus