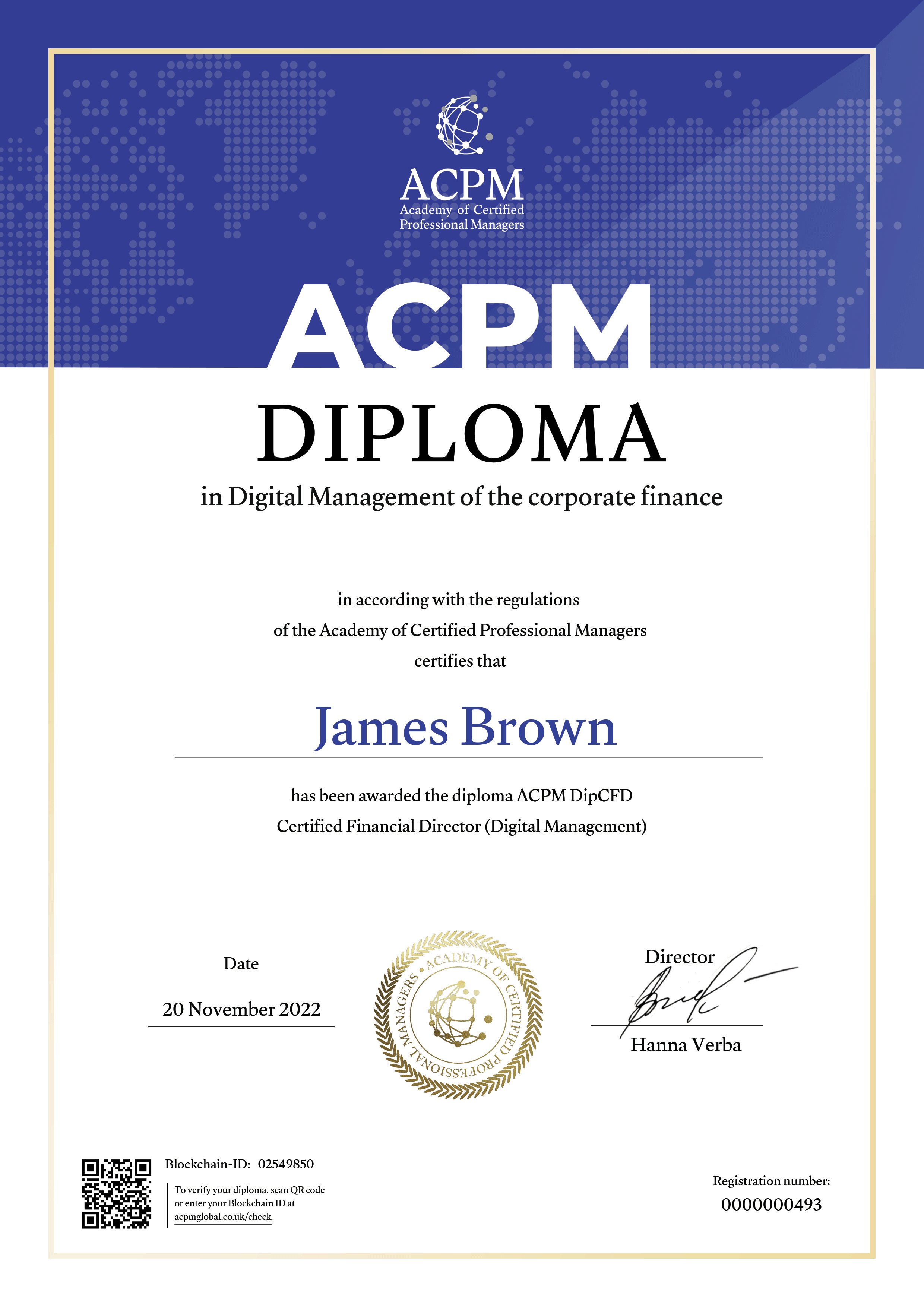

International programme

Certified Financial Director

Digital Management of the corporate finance

Apply for the programmeDigital Management of the corporate finance

Management Accountant

Modules

Topics

1.1. Nature of management accounting

- Definition of management accounting

- Definition of management accounting

- Fundamental differences between management and financial accounting

- Components of management accounting

- Essence of management accounting

- Objectives of management accounting

- Key users of management accounting

- Individuals responsible for establishing the management accounting system in an organization

- Tasks of management accounting

- Main components of the management accounting system in an organization

- Primary processes ensuring the formation and operation of the management accounting system

- Factors influencing the establishment of the management accounting system in organizations

1.2. Cost classification for decision making

- Definition of costs and methods of cost classification

- Cost categories: fixed, variable, average, marginal

- Other types of costs

- Models and methods of product costing

Topics

2.1 Cost management concept. Costing methods

- Segregation of costs into fixed and variable

- Costing of production costs

2.2. Cost-Volume-Profit analysis. Break-even point

- Essence of CVP analysis. Break-even analysis

- Companies with high fixed and variable costs

Topics

3.1. Managerial analysis: profit maximization methods. Managerial Income Statement format

- Income Statement for managerial decision-making. Possible options for constructing an Income Statement

- Algorithm for compiling an Income Statement for management accounting purposes

3.2. Analysis of sales structure and profitability of individual product types

- Sales analysis. ABC sales analysis

- XYZ sales analysis

- Analysis of sales profitability

- Factor analysis of sales profitability

Topics

4.1. Pricing

- Objectives of pricing

- Types of сosts

- Cost-based pricing methods

- Market-based pricing methods

- Conclusions on pricing methods

- Price elasticity of demand

- Parametric pricing methods

Topics

5.1. Budgeting, types of budgets, Master Budget

- Budget and types of budgets

- What is budgeting

- Factor analysis of cost by cost categories

5.2. Responsibility centers

- Essence of responsibility centers, their role, advantages, and disadvantages

- Financial responsibility centers and their key Indicators

- Cost center accounting

Topics

6.1. Financial control: financial performance indicators

- System of financial ratios

- Operational analysis indicators

- Operational cost indicators

- Efficiency indicators for asset management

- Liquidity indicators

- Profitability indicators

- Capital structure indicators

- Debt service indicators

- Market Indicators

6.2. Financial control tools: flexible budget and transfer pricing

- Flexible budgets and control

- Transfer pricing

- Essence, necessity, and objectives of transfer pricing

- Factors influencing the establishment of transfer prices

- Mechanism of transfer pricing based on market price

- Pricing based on market prices

- Types of pricing based on full and marginal costs

- Other types of transfer pricing

Topics

7.1. Segment reporting

- Role of segment reporting with a real example

- Procedure for forming segment management reporting

7.2. Management control: non-financial performance indicators

- Internal non-financial indicators

- External non-financial indicators

- Interconnection of financial and non-financial indicators

Topics

8.1. Development of management control system: Balanced Scorecard

- Objectives of developing the Balanced Scorecard (BSC)

- Components of the Balanced Scorecard

- Income approach valuation

- Typical project for developing the Balanced Scorecard

- Utilizing financial analysis within the Balanced Scorecard framework

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.

Financial Management

Modules

Topics

1.1. The essence of finance and the financial management system in an enterprise

- Content and purpose of enterprise finance

- Composition of financial resources of enterprises:

- Financial management as the art of managing enterprise finances

- Principles of organizing financial management

- Financial management system in an enterprise

- Functions of a financial manager

1.2. Analysis of financial statements – the basis for making financial decisions

- Composition of financial statements. Goals and main directions of financial analysis. Methods of financial analysis

- Analysis of trends and vertical analysis

- Features of financial ratio analysis

- Analysis based on the DuPont model

Topics

2.1 Budgeting

- The planning process in an enterprise

- Budgeting system

- Strategic, tactical, and operational planning

2.2. Intangible assets and asset impairment

- Forecasting. Key stages of forecasting

- Basic forecasting methods

- Sales forecasting

2.3. Financial reporting forecasting

- Forecasting financial statements

- Factors influencing the need for external financing

- Forecasting financial needs in the presence of fluctuating financial indicators for the company

Topics

3.1. Management analysis: profit maximization methods

- Cost structure analysis

- Analytical profit and loss statement with emphasis on marginal profit

- Break-even analysis of the enterprise

- Operating leverage effect

- Choosing the optimal product mix structure

Topics

4.1. Sources of business financing

- Internal and external sources of financing for organizational activities, factors of financial equilibrium. Concept, structure, and purpose of financial markets

- Financial institutions, their purpose, and tasks

- Types of short-term credits. Conditions of trade credit

- Minimizing the cost of short-term credit

- Securities as a tool for attracting financial resources

- Types of securities

- Methods of securities valuation

- Evaluation of bonds

- Evaluation of stocks

Topics

5.1. Working capital management

- Definitions, significance, and characteristics of working capital management. Operational and financial cycles

- Inventory management

- Accounts receivable management

- Cash management

- Working capital financing policy

Topics

6.1. Long-term financial decisions

- Definition of investments, types of investments. Nature of investment decisions. Time value of money concept. Annuities. Future and present value of annuity

- Methods of investment appraisal

- Consideration of inflation, taxation, risks, and uncertainty

Topics

7.1. Risk and return: basic concepts

- Interest rate risk and currency risk. Methods and tools for risk management

- Methods of financial risk neutralization

- Insurance, hedging, diversification

7.2. Cost of capital and capital structure decisions

- Cost of capital. Weighted average cost of capital

- Factors influencing the capital structure

- Corporate capital structure policy and the impact of capital structure on enterprise value

- Dividend policy

- Types of dividend policies

- Factors influencing the choice of dividend policy

- Dividend policy and stock price regulation

Topics

8.1. Measurement of business value for shareholders

- Concept of value and types of value. Creating value for shareholders. Methods for determining the value of an ongoing enterprise

- Cost approach valuation

- Income approach valuation

- Comparable sales approach

- Managing business through Shareholder Value Analysis (SVA)

- Economic Value Added (EVA). Comparing EVA and SVA

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.

IFRS

Modules

Topics

1.1. Objectives, composition, and content of financial statements under IFRS

- Purpose of financial statements

- Composition of financial statements: — IAS 1 Presentation of Financial Statements

- Contents of financial statements (practice)

1.2. Conceptual and methodological basis of finance reporting

- Principles of preparing financial statements

- Qualitative characteristics of reporting

1.3. Types of measurements. Discounted value

- Types of measurements

- Discounted value:

— IFRS 13 Fair Value Measurement. - Interest and Future Value

- Present (Discounted) Value

- Annuities

1.4. Development of the company's accounting policy

- Key requirements for the accounting policy:

— IAS 8 (IFRS) Accounting Policies, Changes in Accounting

Estimates and Errors. - Changes in accounting policy and changes in estimates

- Recognition of errors and methods of their correction

Topics

2.1 Long-Term tangible assets

- Property, plant, and equipment:

— IAS 16 Property, Plant and Equipment. - Investment property:

— IAS 40 Investment Property.

2.2. Intangible assets and asset impairment

- Intangible assets, types:

— IAS 38 Intangible Assets. - Assessment after recognition

- Useful life

- Asset impairment:

— IAS 36 Impairment of Assets. - Recognition and measurement of losses

- Goodwill

Topics

3.1. Current assets

- Inventories —

— IAS 2 Inventories - Inventory impairment

- Useful life

- Methods of cost assessment

- Recognition as expenses

3.2. Non-current assets held for sale and discontinued operations

- Recognition criteria, initial and subsequent evaluation

— IFRS 5 Non-current Assets Held for Sale and Discontinued Operations - Presentation in financial statements

3.3. Provisions, contingent liabilities

- Definition, recognition criteria, initial and subsequent assessment

— IAS 37 Provisions, Contingent Liabilities and Contingent Assets - Contingent liabilities

Topics

4.1. Financial instruments

- Recognition and measurement of financial assets and financial liabilities

— IFRS 9 Financial Instruments - Disclosure and presentation of information

— IAS 32 Financial Instruments: Presentation

— IFRS 7 Financial Instruments: Disclosures

4.2. Leases

- Principles of recognition, measurement, presentation, and disclosure

— IFRS 16 Leases - Accounting for the Right-of-Use asset and lease liability in lessee's financial statements

- Accounting for sale and leaseback in lessee's financial statements

- Accounting for leases in lessor's financial statements

Topics

5.1. Recognition of revenues and expenses

- Principles of reporting revenue and cash flows from contracts with customers

— IFRS 15 Revenue from Contracts with Customers - Five-step model for revenue recognition

- Costs related to contracts

5.2. Statement of cash flows

- Requirements and definitions

— IAS 7 Statement of Cash Flows - Cash and cash equivalents

- Presentation of the statement of cash flows

- Operating, investing, and financing activities

Topics

6.1. Forms of investments in other companies

- Investments in associates and joint ventures

— IAS 28 Investments in Associates and Joint Ventures - Joint operations

— IFRS 11 Joint Arrangements

6.2. Business combinations and consolidated financial statements

- Business combinations

— IFRS 3 Business Combinations - Consolidated financial statements

— IFRS 10 Consolidated Financial Statements - Disclosure of information

— IFRS 12 Disclosure of Interests in Other Entities

Topics

7.1. (IAS) 21 The Effects of Changes in Foreign Exchange Rates

- Reflecting transactions in foreign currencies in the functional currency

- Accounting for transactions and balances denominated in foreign currencies

7.2. (IAS) 23 Borrowing Costs

- Recognition and commencement of capitalization

- Suspension and cessation of capitalization

- Disclosure requirements

7.3. (IAS) 24 Related Party Disclosures

- Scope of application

- Groups of companies

- Related party

- Disclosure requirements

7.4. Other special topics

- (IAS) 24 Interim Financial Reporting

- (IFRS) 1 First-time Adoption of International Financial Reporting Standards

Topics

8.1. Other aspects of financial reporting and financial accounting

- (IAS) 10 Events After the Reporting Period

- (IAS) 12 Income Taxes

- (IAS) 20 Accounting for Government Grants and Disclosure of Government Assistance

8.2. Industry-specific financial reporting standards

- (IAS) 41 Agriculture

- (IFRS) 4 Insurance Contracts

- (IFRS) 6 Exploration for and Evaluation of Mineral Resources

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.

Practical Experience in Budgeting within the Company

Modules

Topics

- Budgeting

- Objectives, stages, components of budgeting

- Budgetary control loop

- Types, formats of budgets

- Practical task:

- Compilation of coordinated functional budgets, consolidated budget

Topics

- Budgetary cycle

- Rolling budgeting

- Bottom-up, top-down, reconciliatory budgeting

- Incremental budgeting

- Zero-based budgeting

- Post-process budgeting

- Practical task:

- Compilation of a budget using the post-process budgeting method

Topics

- Forecasting

- Components of time series

- Trend derivation

- Identifying seasonal fluctuations within additive and proportional models

- Reliability calculation of forecasts

- Practical task:

- Compilation of sales volume forecast

Topics

- Diagnosis and optimization of financial structure

- Cash Flow from Operations (CFO)

- Monitoring and evaluation of budget performance

- Anticipatory control

- Behavioral reactions in budgeting

- Practical task:

- Evaluation of financial structure, changes in financial structure. Establishing financial responsibility areas, defining indicators for monitoring and evaluation. Solving company challenges using motivational indicators.

Financial Analysis: Modern Tools and Effective Management Solutions

Modules

Topics

- Concept of successful business. Company value management concept

- Objectives and content of financial analysis

- Sources of information for analysis

- Financial statements and their conversion into analytical form

- Balance sheet. Liquidity table

- Income statement

- Statement of cash flows. Direct and indirect methods

- Shortcomings of financial statements, manipulation techniques

- Expert assessments

- Practical task:

Compilation of financial statements

Topics

- Financial statement analysis

- Vertical, horizontal, trend analysis

- Relationship between asset structure and operational efficiency

- Sources of financing, their structure, and risks. Financial stability

- Revenues and expenses. Levels of financial performance. Analysis of structure and dynamics

- Structure of the VAT report and stages of the company's life cycle

- Operating, financial, and total leverage ratios

- Methods of accounting for the impact of taxes and inflation

- Practical task:

- Financial statement analysis

Topics

- Analysis using financial ratios

- Liquidity ratios

- Leverage ratios

- Coverage ratios

- Business activity ratios

- Profitability ratios

- Market value ratios

- Two-factor model of asset profitability

- Three-factor model of equity profitability

- Analysis of reserves for improving company efficiency

- Practical task:

- Ratio analysis. Determining the size of accounts receivable a company can afford

Topics

- Making management decisions based on financial analysis

- Balanced growth

- Forecasting prospective financial indicators based on actuals

- Economic profit indicators (RI, EVA, TSR)

- Organization of systematic analytical work in the company

- Practical task:

- Determining the amount of financing needed to support the company's operations. How much cash can be withdrawn from the business.

Business Data Analysis in Finance

Modules

Topics

1.1. Fundamentals of data analysis in Microsoft Power BI

- What is data analysis?

- Principles of practical data analysis

- What is Microsoft Power BI and how to use it

- Tests: Fundamentals of data analysis in Microsoft Power BI

1.2. Basics of budgeting in Power BI

- Advantages of digital budgeting

- Hierarchy in budgeting and linking different budgets

- Logic of building budget dashboards

- Tests: Basics of budgeting in Power BI

1.3. Case: Budget request

- Formulating and analyzing a business budget

- Choosing metrics and dimensions, performing calculations

- Providing recommendations for key budget assessment indicators

- Practical task: Stages of building charts for the "Budget request"

1.4 Case: Plan-fact for the 1st half of the year

- Analyzing the efficiency of business operations by areas (personnel, sales, finance)

- Choosing metrics and dimensions, performing calculations

- Providing comments and explanations for key business performance facts

- Practical task: Stages of building charts for "Plan-Fact for the 1st half of the Year"

1.5 Case: 5-Year Business Plan

- Planning business operations for the next 5 years in key areas (sales, revenue, net profit)

- Choosing metrics and dimensions, performing calculations

- Building dashboards for a quick assessment of the business strategy

- Practical task: Stages of building charts for a "5-Year Business Plan"

Topics

2.1. Fundamentals of the digital economy

- Essence of the digital economy and its differences from the real economy

- Success factors and drawbacks of the digital economy

- How the digital economy changes finances and how a finance professional can adapt

- Tests: Fundamentals of the digital economy

2.2. CFO Transformation into the Digital Realm

- Differences between a traditional CFO and a digital CFO

- How digitalization impacts various aspects of a CFO's role

- Basic skills for CFO transformation and obstacles to transformation

- Test: CFO Transformation into the Digital Realm

2.3. Case: Cash flow budget

- Analyzing the cash flow budget (direction, month, type of activity)

- Choosing metrics, performing calculations

- Identifying cash gaps

- Practical task: Cash flow budget

2.4. Case: Accounts receivable

- Analyzing accounts receivable (amount of debt, debtor, quarter)

- Choosing metrics, performing calculations

- Assisting in managing accounts receivable (who is at risk and who is not?)

- Practical Task: Accounts receivable

2.5. Case: Sales analysis

- Analyzing the effectiveness of product sales (customer, revenue, discount amount)

- Choosing metrics, performing calculations

- Improving product sales (why do some customers get a higher discount than others?)

- Practical task: Sales analysis

Topics

3.1 Finances in the art of visualization

- Charts and dashboards as the foundation of modern visualization

- Best types of charts for use in finance

- Methods to enhance charts

- Tests: Finances in the art of visualization

3.2 How modern visualization is built in Power BI

- Data analysis techniques for visualization

- How calculations and measures are used in visualization

- Increasing the effectiveness and clarity of visualizations using 6 techniques

- Tests: How modern visualization is built in Power BI

3.3 Case: Internet advertising

- Analyzing the effectiveness of internet advertising (countries, devices)

- Choosing metrics and dimensions, performing calculations and groupings

- Cost-saving on advertising sales (why are we not selling more to Norway?)

- Practical task: Internet Advertising

3.4 Case: Features of car sales

- Analyzing the effectiveness of car sales (color, model)

- Choosing metrics and dimensions, performing calculations and groupings

- Improving car sales (why is having many colors a disadvantage?)

- Practical task: Features of car sales

3.5 Case: Working with Walmart

- Analyzing the effectiveness of product sales at Walmart (category, price)

- Choosing metrics and dimensions, performing calculations and groupings

- Planning what to sell at Walmart (why are we selling the cheapest products?)

- Practical task: Working with Walmart

Topics

4.1 Planning for finance professionals in the digital era

- Objectives and criteria of modern planning

- Key aspects of financial plans

- Can digital help traditional planning?

4.2 Transformation of planning tasks in the digital era

- Transformation of planning tasks

- Dynamic integration of plans and budgets

- Data usage culture among finance professionals

4.3 Case: Planning internet sales

- Analyzing the effectiveness of sales (countries, selling price, cost)

- Choosing metrics and dimensions, performing calculations and groupings

- Analyzing the sales and production plan (trying to clearly understand where and how much to sell)

- Practical task: Planning internet sales

4.4 Case: Cost planning

- Modeling sales plan, revenue, variable and fixed costs

- Configuring calculations, performing computations

- Attempting to graphically impact net profit through cost optimization

- Practical task: Cost planning

4.5 Case: Dynamic planning in retail

- Modeling sales under conditions of uncertainty

- Choosing parameters that affect revenue and net profit, adjusting them

- Considering the business's readiness for a discount on goods and a reduction in quantity (stress scenario?)

- Practical task: Dynamic planning in retail

Topics

5.1 Practical application of business analysis

- What is practical business analysis?

- Why is practical business analysis important for business?

- What should be known in terms of practical business analysis

5.2 Game case Business analytics for online advertising

- Looking at real data

- Choosing numerical metrics for comparison, discussing them

- Analyzing our advertising based on metrics, examining effectiveness through graphs and charts

5.3 Case Business analytics in the hotel business

- Examining real data: what is the specificity of this business

- Selecting numerical metrics and analyzing business development

- Trying to make a complex decision based on data - to close or not?

5.4 Case Business analytics for real estate agent

- What is the specificity of the data available to real estate agents? There is a lot of it!

- Choosing metrics and segments, describing key points

- Examining our product and the geography of our sales in detail

5.5 Case Business analytics for medical clinics

- How to analyze data in the medical field, are there any peculiarities?

- Choosing metrics and segments, trying to understand the difference between key concepts

- Analyzing the workload of doctors, identifying the best and not so good ones. Providing recommendations on working hours and staff training.

Innovation Management of the Company

Modules

Topics

1.1. What are innovations and their role in business

1.2. Innovative companies

1.3. Innovation creation process

- Stages of creating new solutions

- Innovation funnel

Topics

2.1. Preparation for creating an innovation strategy ("Where Are We Now?")**

- Assessment of the innovation climate and opportunities within the company

- Business strategy for preparing the innovation strategy

2.2 Defining future opportunities ("Where Do We Want to Go?")**

- Business growth horizons

- Mission and goals of innovation

2.3 Defining the innovation portfolio ("How Will We Get There?")**

- Innovation projects

- Initiatives - identifying the necessary activities to achieve goals

- Team, responsible individuals, and innovation leaders in the company

- Budget and resources

- Criteria for the success of projects

Topics

3.1 Approaches to the innovation creation process

- Stage-gate approach

- Lean startup approach

3.2 Measuring innovation activity

- Innovation metrics

- Tracking performance indicators of innovation teams

3.3 Evaluation and decision-making for projects

3.4 Organizational structure of an innovative company

- Ambidextrous companies

- Selection of organizational structure

- Placement of innovative teams

3.5 Innovation culture

- Communication

- Skills and training

- Principles of building an innovation culture

Part 1. Management Accountant

Nature of Management Accounting. Cost Classification for Decision Making.

Topics

1.1. Nature of management accounting

- Definition of management accounting

- Definition of management accounting

- Fundamental differences between management and financial accounting

- Components of management accounting

- Essence of management accounting

- Objectives of management accounting

- Key users of management accounting

- Individuals responsible for establishing the management accounting system in an organization

- Tasks of management accounting

- Main components of the management accounting system in an organization

- Primary processes ensuring the formation and operation of the management accounting system

- Factors influencing the establishment of the management accounting system in organizations

1.2. Cost classification for decision making

- Definition of costs and methods of cost classification

- Cost categories: fixed, variable, average, marginal

- Other types of costs

- Models and methods of product costing

Module 2. Cost Management Concept. Methods of Costing. Cost-Volume-Profit Analysis. Break-even Point

Topics

2.1 Cost management concept. Costing methods

- Segregation of costs into fixed and variable

- Costing of production costs

2.2. Cost-Volume-Profit analysis. Break-even point

- Essence of CVP analysis. Break-even analysis

- Companies with high fixed and variable costs

Module 3. Managerial Format of the Income Statement. Analysis of Sales Structure and Profitability of Individual Product Types

Topics

3.1. Managerial analysis: profit maximization methods. Managerial Income Statement format

- Income Statement for managerial decision-making. Possible options for constructing an Income Statement

- Algorithm for compiling an Income Statement for management accounting purposes

3.2. Analysis of sales structure and profitability of individual product types

- Sales analysis. ABC sales analysis

- XYZ sales analysis

- Analysis of sales profitability

- Factor analysis of sales profitability

Module 4. Pricing

Topics

4.1. Pricing

- Objectives of pricing

- Types of сosts

- Cost-based pricing methods

- Market-based pricing methods

- Conclusions on pricing methods

- Price elasticity of demand

- Parametric pricing methods

Module 5. Budgeting; Types of Budgets; Master Budget; Responsibility Centers

Topics

5.1. Budgeting, types of budgets, Master Budget

- Budget and types of budgets

- What is budgeting

- Factor analysis of cost by cost categories

5.2. Responsibility centers

- Essence of responsibility centers, their role, advantages, and disadvantages

- Financial responsibility centers and their key Indicators

- Cost center accounting

Module 6. Financial Control: Financial Performance Indicators. Financial Control Tools: Flexible Budget and Transfer Pricing

Topics

6.1. Financial control: financial performance indicators

- System of financial ratios

- Operational analysis indicators

- Operational cost indicators

- Efficiency indicators for asset management

- Liquidity indicators

- Profitability indicators

- Capital structure indicators

- Debt service indicators

- Market Indicators

6.2. Financial control tools: flexible budget and transfer pricing

- Flexible budgets and control

- Transfer pricing

- Essence, necessity, and objectives of transfer pricing

- Factors influencing the establishment of transfer prices

- Mechanism of transfer pricing based on market price

- Pricing based on market prices

- Types of pricing based on full and marginal costs

- Other types of transfer pricing

Module 7. Segment Reporting. Management Control: Non-Financial Performance Indicators

Topics

7.1. Segment reporting

- Role of segment reporting with a real example

- Procedure for forming segment management reporting

7.2. Management control: non-financial performance indicators

- Internal non-financial indicators

- External non-financial indicators

- Interconnection of financial and non-financial indicators

Module 8. Development of Management Control System: Balanced Scorecard

Topics

8.1. Development of management control system: Balanced Scorecard

- Objectives of developing the Balanced Scorecard (BSC)

- Components of the Balanced Scorecard

- Typical project for developing the Balanced Scorecard

- Utilizing financial analysis within the Balanced Scorecard framework

Module 9. The concluding assessment. Mock exam.

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.

Part 2. Financial Management

Module 1.The Essence of Finance and the Financial Management System in an Enterprise. Analysis of Financial Statements is the Foundation for Making Financial Decisions.

Topics

1.1. The essence of finance and the financial management system in an enterprise

- Content and purpose of enterprise finance

- Composition of financial resources of enterprises:

- Financial management as the art of managing enterprise finances

- Principles of organizing financial management

- Financial management system in an enterprise

- Functions of a financial manager

1.2. Analysis of financial statements – the basis for making financial decisions

- Composition of financial statements. Goals and main directions of financial analysis. Methods of financial analysis

- Analysis of trends and vertical analysis

- Features of financial ratio analysis

- Analysis based on the DuPont model

Module 2. Financial Planning and Financial Forecasting

Topics

2.1 Budgeting

- The planning process in an enterprise

- Budgeting system

- Strategic, tactical, and operational planning

2.2. Intangible assets and asset impairment

- Forecasting. Key stages of forecasting

- Basic forecasting methods

- Sales forecasting

2.3. Financial reporting forecasting

- Forecasting financial statements

- Factors influencing the need for external financing

- Forecasting financial needs in the presence of fluctuating financial indicators for the company

Module 3. Management Analysis: Profit Maximization Methods

Topics

3.1. Management analysis: profit maximization methods

- Cost structure analysis

- Analytical profit and loss statement with emphasis on marginal profit

- Break-even analysis of the enterprise

- Operating leverage effect

- Choosing the optimal product mix structure

Module 4. Sources of Business Financing

Topics

4.1. Sources of business financing

- Internal and external sources of financing for organizational activities, factors of financial equilibrium. Concept, structure, and purpose of financial markets

- Financial institutions, their purpose, and tasks

- Types of short-term credits. Conditions of trade credit

- Minimizing the cost of short-term credit

- Securities as a tool for attracting financial resources

- Types of securities

- Methods of securities valuation

- Evaluation of bonds

- Evaluation of stocks

Module 5. Working Capital Management

Topics

5.1. Working capital management

- Definitions, significance, and characteristics of working capital management. Operational and financial cycles

- Inventory management

- Accounts receivable management

- Cash management

- Working capital financing policy

Module 6. Long-Term Financial Decisions

Topics

6.1. Long-term financial decisions

- Definition of investments, types of investments. Nature of investment decisions. Time value of money concept. Annuities. Future and present value of annuity

- Methods of investment appraisal

- Consideration of inflation, taxation, risks, and uncertainty

Module 7. Risk and Return: Basic Concepts. Cost of Capital and Capital Structure Decisions

Topics

7.1. Risk and return: basic concepts

- Interest rate risk and currency risk. Methods and tools for risk management

- Methods of financial risk neutralization

- Insurance, hedging, diversification

7.2. Cost of capital and capital structure decisions

- Cost of capital. Weighted average cost of capital

- Factors influencing the capital structure

- Corporate capital structure policy and the impact of capital structure on enterprise value

- Dividend policy

- Types of dividend policies

- Factors influencing the choice of dividend policy

- Dividend policy and stock price regulation

Module 8. Measurement of Business Value for Shareholders

Topics

- Concept of value and types of value. Creating value for shareholders. Methods for determining the value of an ongoing enterprise

- Cost approach valuation

- Income approach valuation

- Comparable sales approach

- Managing business through Shareholder Value Analysis (SVA)

- Economic Value Added (EVA). Comparing EVA and SVA

Module 9. The concluding assessment. Mock exam.

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.

Part 3. IFRS

Module 1. Introduction - (IAS) 1, (IFRS) 13, (IAS) 8

Topics

1.1. Objectives, composition, and content of financial statements under IFRS

- Purpose of financial statements

- Composition of financial statements: — IAS 1 Presentation of Financial Statements

- Contents of financial statements (practice)

1.2. Conceptual and methodological basis of finance reporting

- Principles of preparing financial statements

- Qualitative characteristics of reporting

1.3. Types of measurements. Discounted value

- Types of measurements

- Discounted value:

— IFRS 13 Fair Value Measurement. - Interest and Future Value

- Present (Discounted) Value

- Annuities

1.4. Development of the company's accounting policy

- Key requirements for the accounting policy:

— IAS 8 (IFRS) Accounting Policies, Changes in Accounting

Estimates and Errors. - Changes in accounting policy and changes in estimates

- Recognition of errors and methods of their correction

Module 2. Assets - (IAS) 16, (IAS) 40, (IAS) 38, (IAS) 36

Topics

2.1 Long-Term tangible assets

- Property, plant, and equipment:

— IAS 16 Property, Plant and Equipment. - Investment property:

— IAS 40 Investment Property.

2.2. Intangible assets and asset impairment

- Intangible assets, types:

— IAS 38 Intangible Assets. - Assessment after recognition

- Useful life

- Asset impairment:

— IAS 36 Impairment of Assets. - Recognition and measurement of losses

- Goodwill

Module 3. Assets - (IAS) 2, (IFRS) 5, (IAS) 37

Topics

3.1. Current assets

- Inventories —

— IAS 2 Inventories - Inventory impairment

- Useful life

- Methods of cost assessment

- Recognition as expenses

3.2. Non-current assets held for sale and discontinued operations

- Recognition criteria, initial and subsequent evaluation

— IFRS 5 Non-current Assets Held for Sale and Discontinued Operations - Presentation in financial statements

3.3. Provisions, contingent liabilities

- Definition, recognition criteria, initial and subsequent assessment

— IAS 37 Provisions, Contingent Liabilities and Contingent Assets - Contingent liabilities

Module 4. Financial Instruments. Leases - (IFRS) 9, (IAS) 32, (IFRS) 7, (IFRS) 16

Topics

4.1. Financial instruments

- Recognition and measurement of financial assets and financial liabilities

— IFRS 9 Financial Instruments - Disclosure and presentation of information

— IAS 32 Financial Instruments: Presentation

— IFRS 7 Financial Instruments: Disclosures

4.2. Leases

- Principles of recognition, measurement, presentation, and disclosure

— IFRS 16 Leases - Accounting for the Right-of-Use asset and lease liability in lessee's financial statements

- Accounting for sale and leaseback in lessee's financial statements

- Accounting for leases in lessor's financial statements

Module 5. Recognition of Revenues and Expenses. Statement of Cash Flows - (IFRS) 15, (IAS) 7

Topics

5.1. Recognition of revenues and expenses

- Principles of reporting revenue and cash flows from contracts with customers

— IFRS 15 Revenue from Contracts with Customers - Five-step model for revenue recognition

- Costs related to contracts

5.2. Statement of cash flows

- Requirements and definitions

— IAS 7 Statement of Cash Flows - Cash and cash equivalents

- Presentation of the statement of cash flows

- Operating, investing, and financing activities

Module 6. Forms of Investments in Other Companies. Business Combinations and Consolidated Financial Statements - (IAS) 28, (IFRS) 11, (IFRS) 3, (IFRS) 10, (IFRS) 12

Topics

6.1. Forms of investments in other companies

- Investments in associates and joint ventures

— IAS 28 Investments in Associates and Joint Ventures - Joint operations

— IFRS 11 Joint Arrangements

6.2. Business combinations and consolidated financial statements

- Business combinations

— IFRS 3 Business Combinations - Consolidated financial statements

— IFRS 10 Consolidated Financial Statements - Disclosure of information

— IFRS 12 Disclosure of Interests in Other Entities

Module 7. Special Topics in Financial Reporting - (IAS) 21, (IAS) 23, (IAS) 24, (IAS) 24, (IFRS) 1

Topics

7.1. (IAS) 21 The Effects of Changes in Foreign Exchange Rates

- Reflecting transactions in foreign currencies in the functional currency

- Accounting for transactions and balances denominated in foreign currencies

7.2. (IAS) 23 Borrowing Costs

- Recognition and commencement of capitalization

- Suspension and cessation of capitalization

- Disclosure requirements

7.3. (IAS) 24 Related Party Disclosures

- Scope of application

- Groups of companies

- Related party

- Disclosure requirements

7.4. Other special topics

- (IAS) 24 Interim Financial Reporting

- (IFRS) 1 First-time Adoption of International Financial Reporting Standards

Module 8. Other Aspects of Financial Reporting. Industry Standards - (IAS) 10, (IAS) 12, (IAS) 20, (IAS) 41, (IFRS) 4, (IFRS) 6

Topics

8.1. Other aspects of financial reporting and financial accounting

- (IAS) 10 Events After the Reporting Period

- (IAS) 12 Income Taxes

- (IAS) 20 Accounting for Government Grants and Disclosure of Government Assistance

8.2. Industry-specific financial reporting standards

- (IAS) 41 Agriculture

- (IFRS) 4 Insurance Contracts

- (IFRS) 6 Exploration for and Evaluation of Mineral Resources

Module 9. The concluding assessment. Mock exam.

Topics

Module 9 represents an equivalent of the upcoming online exam:

- It includes a test (20 questions, 2 points each, maximum score - 40 points, automatically checked and assessed).

- And assignments (4 tasks, maximum total score - 60, evaluated by the instructor).

- Just like in the exam, the goal is to achieve a total of 60 points out of 100 for both the test and assignments.

Practical Part. Practical Experience in Budgeting within the Company

Session 1

Topics

- Budgeting

- Objectives, stages, components of budgeting

- Budgetary control loop

- Types, formats of budgets

- Practical task:

- Compilation of coordinated functional budgets, consolidated budget

Session 2

Topics

- Budgetary cycle

- Rolling budgeting

- Bottom-up, top-down, reconciliatory budgeting

- Incremental budgeting

- Zero-based budgeting

- Post-process budgeting

- Practical task:

- Compilation of a budget using the post-process budgeting method

Session 3

Topics

- Forecasting

- Components of time series

- Trend derivation

- Identifying seasonal fluctuations within additive and proportional models

- Reliability calculation of forecasts

- Practical task:

- Compilation of sales volume forecast

Session 4

Topics

- Diagnosis and optimization of financial structure

- Cash Flow from Operations (CFO)

- Monitoring and evaluation of budget performance

- Anticipatory control

- Behavioral reactions in budgeting

- Practical task:

- Evaluation of financial structure, changes in financial structure. Establishing financial responsibility areas, defining indicators for monitoring and evaluation. Solving company challenges using motivational indicators.

Part 4. Financial Analysis: Modern Tools and Effective Management Solutions

Session 1

Topics

- Concept of successful business. Company value management concept

- Objectives and content of financial analysis

- Sources of information for analysis

- Financial statements and their conversion into analytical form

- Balance sheet. Liquidity table

- Income statement

- Statement of cash flows. Direct and indirect methods

- Shortcomings of financial statements, manipulation techniques

- Expert assessments

- Practical task:

Compilation of financial statements

Session 2

Topics

- Financial statement analysis

- Vertical, horizontal, trend analysis

- Relationship between asset structure and operational efficiency

- Sources of financing, their structure, and risks. Financial stability

- Revenues and expenses. Levels of financial performance. Analysis of structure and dynamics

- Structure of the VAT report and stages of the company's life cycle

- Operating, financial, and total leverage ratios

- Methods of accounting for the impact of taxes and inflation

- Practical task:

- Financial statement analysis

Session 3

Topics

- Analysis using financial ratios

- Liquidity ratios

- Leverage ratios

- Coverage ratios

- Business activity ratios

- Profitability ratios

- Market value ratios

- Two-factor model of asset profitability

- Three-factor model of equity profitability

- Analysis of reserves for improving company efficiency

- Practical task:

- Ratio analysis. Determining the size of accounts receivable a company can afford

Session 4

Topics

- Making management decisions based on financial analysis

- Balanced growth

- Forecasting prospective financial indicators based on actuals

- Economic profit indicators (RI, EVA, TSR)

- Organization of systematic analytical work in the company

- Practical task:

- Determining the amount of financing needed to support the company's operations. How much cash can be withdrawn from the business.

Part 5. Business Data Analysis in Finance

Module 1. Microsoft Power BI for Finance Professionals

Topics

1.1. Fundamentals of data analysis in Microsoft Power BI

- What is data analysis?

- Principles of practical data analysis

- What is Microsoft Power BI and how to use it

- Tests: Fundamentals of data analysis in Microsoft Power BI

1.2. Basics of budgeting in Power BI

- Advantages of digital budgeting

- Hierarchy in budgeting and linking different budgets

- Logic of building budget dashboards

- Tests: Basics of budgeting in Power BI

1.3. Case: Budget request

- Formulating and analyzing a business budget

- Choosing metrics and dimensions, performing calculations

- Providing recommendations for key budget assessment indicators

- Practical task: Stages of building charts for the "Budget request"

1.4 Case: Plan-fact for the 1st half of the year

- Analyzing the efficiency of business operations by areas (personnel, sales, finance)

- Choosing metrics and dimensions, performing calculations

- Providing comments and explanations for key business performance facts

- Practical task: Stages of building charts for "Plan-Fact for the 1st half of the Year"

1.5 Case: 5-Year Business Plan

- Planning business operations for the next 5 years in key areas (sales, revenue, net profit)

- Choosing metrics and dimensions, performing calculations

- Building dashboards for a quick assessment of the business strategy

- Practical task: Stages of building charts for a "5-Year Business Plan"

Module 2. Digital Transformation for CFOs

Topics

2.1. Fundamentals of the digital economy

- Essence of the digital economy and its differences from the real economy

- Success factors and drawbacks of the digital economy

- How the digital economy changes finances and how a finance professional can adapt

- Tests: Fundamentals of the digital economy

2.2. CFO Transformation into the Digital Realm

- Differences between a traditional CFO and a digital CFO

- How digitalization impacts various aspects of a CFO's role

- Basic skills for CFO transformation and obstacles to transformation

- Test: CFO Transformation into the Digital Realm

2.3. Case: Cash flow budget

- Analyzing the cash flow budget (direction, month, type of activity)

- Choosing metrics, performing calculations

- Identifying cash gaps

- Practical task: Cash flow budget

2.4. Case: Accounts receivable

- Analyzing accounts receivable (amount of debt, debtor, quarter)

- Choosing metrics, performing calculations

- Assisting in managing accounts receivable (who is at risk and who is not?)

- Practical Task: Accounts receivable

2.5. Case: Sales analysis

- Analyzing the effectiveness of product sales (customer, revenue, discount amount)

- Choosing metrics, performing calculations

- Improving product sales (why do some customers get a higher discount than others?)

- Practical task: Sales analysis

Module 3. Modern Data Visualization in Finance with Microsoft Power BI

Topics

3.1 Finances in the art of visualization

- Charts and dashboards as the foundation of modern visualization

- Best types of charts for use in finance

- Methods to enhance charts

- Tests: Finances in the art of visualization

3.2 How modern visualization is built in Power BI

- Data analysis techniques for visualization

- How calculations and measures are used in visualization

- Increasing the effectiveness and clarity of visualizations using 6 techniques

- Tests: How modern visualization is built in Power BI

3.3 Case: Internet advertising

- Analyzing the effectiveness of internet advertising (countries, devices)

- Choosing metrics and dimensions, performing calculations and groupings

- Cost-saving on advertising sales (why are we not selling more to Norway?)

- Practical task: Internet Advertising

3.4 Case: Features of car sales

- Analyzing the effectiveness of car sales (color, model)

- Choosing metrics and dimensions, performing calculations and groupings

- Improving car sales (why is having many colors a disadvantage?)

- Practical task: Features of car sales

3.5 Case: Working with Walmart

- Analyzing the effectiveness of product sales at Walmart (category, price)

- Choosing metrics and dimensions, performing calculations and groupings

- Planning what to sell at Walmart (why are we selling the cheapest products?)

- Practical task: Working with Walmart

Module 4. Financial Planning in the Digital Era for Finance Professionals

Topics

4.1 Planning for finance professionals in the digital era

- Objectives and criteria of modern planning

- Key aspects of financial plans

- Can digital help traditional planning?

4.2 Transformation of planning tasks in the digital era

- Transformation of planning tasks

- Dynamic integration of plans and budgets

- Data usage culture among finance professionals

4.3 Case: Planning internet sales

- Analyzing the effectiveness of sales (countries, selling price, cost)

- Choosing metrics and dimensions, performing calculations and groupings

- Analyzing the sales and production plan (trying to clearly understand where and how much to sell)

- Practical task: Planning internet sales

4.4 Case: Cost planning

- Modeling sales plan, revenue, variable and fixed costs

- Configuring calculations, performing computations

- Attempting to graphically impact net profit through cost optimization

- Practical task: Cost planning

4.5 Case: Dynamic planning in retail

- Modeling sales under conditions of uncertainty

- Choosing parameters that affect revenue and net profit, adjusting them

- Considering the business's readiness for a discount on goods and a reduction in quantity (stress scenario?)

- Practical task: Dynamic planning in retail

Module 5. Practical Application of Business Analysis

Topics

5.1 Practical application of business analysis

- What is practical business analysis?

- Why is practical business analysis important for business?

- What should be known in terms of practical business analysis

5.2 Game case Business analytics for online advertising

- Looking at real data

- Choosing numerical metrics for comparison, discussing them

- Analyzing our advertising based on metrics, examining effectiveness through graphs and charts

5.3 Case Business analytics in the hotel business

- Examining real data: what is the specificity of this business

- Selecting numerical metrics and analyzing business development

- Trying to make a complex decision based on data - to close or not?

5.4 Case Business analytics for real estate agent

- What is the specificity of the data available to real estate agents? There is a lot of it!

- Choosing metrics and segments, describing key points

- Examining our product and the geography of our sales in detail

5.5 Case Business analytics for medical clinics

- How to analyze data in the medical field, are there any peculiarities?

- Choosing metrics and segments, trying to understand the difference between key concepts

- Analyzing the workload of doctors, identifying the best and not so good ones. Providing recommendations on working hours and staff training.

Part 6. Innovation Management of the Company

1. Introduction

Topics

1.1. What are innovations and their role in business

1.2. Innovative companies

1.3. Innovation creation process

- Stages of creating new solutions

- Innovation funnel

2. Innovation Strategy

Topics

2.1. Preparation for creating an innovation strategy ("Where Are We Now?")**

- Assessment of the innovation climate and opportunities within the company

- Business strategy for preparing the innovation strategy

2.2 Defining future opportunities ("Where Do We Want to Go?")**

- Business growth horizons

- Mission and goals of innovation

2.3 Defining the innovation portfolio ("How Will We Get There?")**

- Innovation projects

- Initiatives - identifying the necessary activities to achieve goals

- Team, responsible individuals, and innovation leaders in the company

- Budget and resources

- Criteria for the success of projects

3. Innovation Management

Topics

3.1 Approaches to the innovation creation process

- Stage-gate approach

- Lean startup approach

3.2 Measuring innovation activity

- Innovation metrics

- Tracking performance indicators of innovation teams

3.3 Evaluation and decision-making for projects

3.4 Organizational structure of an innovative company

- Ambidextrous companies

- Selection of organizational structure

- Placement of innovative teams

3.5 Innovation culture

- Communication

- Skills and training

- Principles of building an innovation culture