ACPM: Personnel accounting in Poland

The program was created for Ukrainian specialists who want to become personnel officers in Poland or to adapt their work experience in this field to Polish realities. It provides all the necessary knowledge and skills so that specialists can get a job as a personnel accountant in a Polish company or a human resources bureau, and develop a career in this direction.

The program involves the study of regulatory legislation on labor issues in Poland. It reveals the practical side of the work of a personnel officer with documentation, reports, and the interaction of a specialist with control authorities and state funds. A separate block of the program is devoted to the calculation of wages, additional payments, and employee benefits.

Requirements for candidates

The certification program involves advanced training, so it is desirable to have a basic education in accounting, personnel accounting or finance.

Training program

Topic

Basics of personnel accountant work and regulatory legislation of labor law in Poland

- Who is a personnel accountant in Poland?

- Regulatory legislation and regulatory authorities

Skills

- Understanding the practical nuances of a personnel accountant work in Poland.

- Knowledge of labor legislation and other regulatory acts governing personnel accounting and all control authorities.

Topic

Employment contracts

- Types of the most popular employment contracts and the influence of the condition type on the employee's remuneration

- Contracts according to the Labor Code

- Contracts according to the Civil Code

- Termination of contracts

Skills

- Preparation of documents regarding official employment and dismissal of employees.

- Drafting and termination of employment contracts in accordance with labor and civil codes.

Topic

.Obligations of the employer

- Preparation for the start of the employee's work

- Interview, contract signing

Skills

- Hiring employees, conducting interviews.

- Documentation of labor relations.

Topic

.Personnel documentation

- Personal documents (A B C D)

- Other documentation

Skills

- TPreparation, maintenance, and storage of employment contracts, attachments, certificates, personnel files, etc.

- Ability to draft acts, orders, etc.

- Preparation of reports.

Topic

.Rates of working hours, holidays

- Working time

- Types of vacations

- Vacations related to parental responsibilities

- Payment for overtime, holidays, night shifts, etc.

Skills

- Keeping records of working hours.

- Ability to calculate payments for standard and overtime work.

- Calculation of holidays and sick leave.

Topic

.Cooperation and obligations to the funds

- ZUS

- US

- GUS, PFRON, PPK

Skills

- Contact with external institutions.

- Payment of social insurance contributions and employee income taxes.

Topic

.Reporting

- Reporting to the tax office (PIT-11, PIT-4R)

- Reporting to the social insurance fund ZUS DRA. RCA, ZUS RSA, ZUS RZA, ZUS RPA

Skills

- Submission of declarations to Social Insurance Institutions, Tax Service, GUS, PFRON, etc.

Topic

.Calculation of wages

- Payments to social insurance (basis of measurement, types)

- Advance contributions from personal income tax

- Calculation of wages, accruals, deductions.

Skills

- Calculation and accounting of wages.

- Calculation of benefits, social security contributions, income taxes.

Topic

.Additional payments to employees

- Benefits — private health insurance, sports card, life insurance

- Company car

- Housing payments and other payments

Skills

- Calculation of rewards and payments.

- Calculation of wages with additional payments.

- Consideration of complex cases.

Skills after completing the program

As a result of preparation for the «ACPM: Personnel accounting in Poland» diploma exam, the candidate has the following knowledge and skills:

- Documenting labor relations, and drawing up contracts.

- Maintaining personnel documentation and personnel files by labor legislation.

- Coordination of hiring employees, conducting interviews.

- Interaction with control authorities, state funds. Preparation of PIT tax returns and reporting to ZUS, GUS, PFRON.

- Keeping records of working hours, holidays and sick days.

- Calculation of wages, taking into account additional payments and complex cases. Compilation of payment information.

- Preparation of reports and analysis of employees' working hours.

- Serving employees regarding current personnel issues.

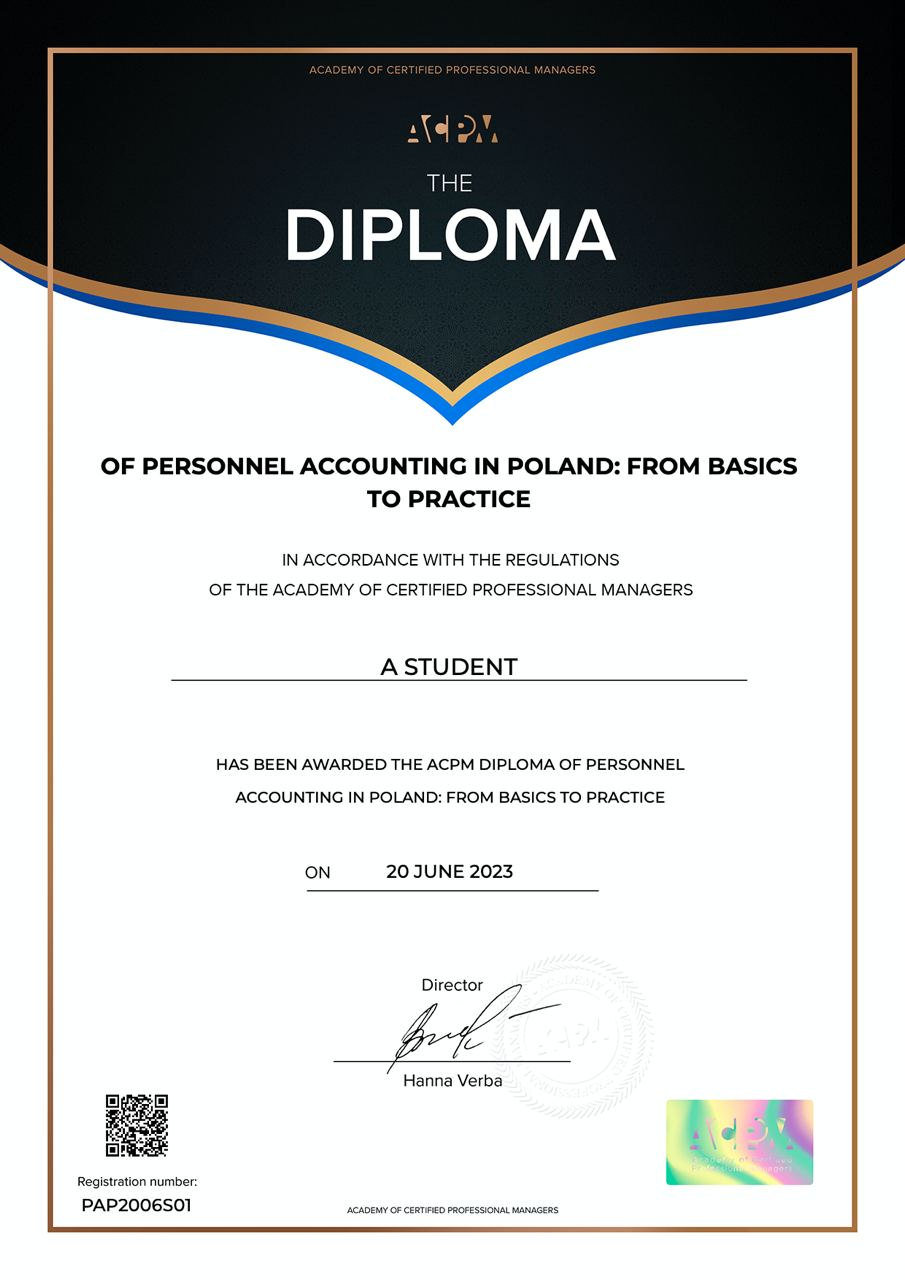

Exam and diploma

Knowledge control takes place on an online exam. The official «ACPM: Personnel accounting in Poland» diploma exam is held monthly according to the schedule. Registration is required to participate in it.

The exam consists of a test and a practical part. The total duration of the exam is 3 hours. The passing score is 60 (maximum score - 100 points).

The exam is conducted by administrators, and the completed assignments are checked and graded by ACPM-accredited instructors.

The exam result is sent by email after 2-3 weeks. If a passing score is 60 or above, the ACPM International Diploma is sent electronically with the results.

More about ACPM diplomas