Professional financial director (FD1pro)

The certification program "ACPM: Professional Financial Director" is suitable for those who want to cover a wide range of professional knowledge in finance and become a certified CFO at an international level.

The program covers four important areas: IFRS, management accounting, internal audit, and risk management. It prepares competent financial specialists capable of guiding companies to sustainable success while effectively identifying, assessing, and managing risks to ensure long-term stability.

Apply for the programmeRequirements for candidates

The certification program provides advanced training. Therefore, basic knowledge of accounting and finance is necessary for its completion.

Training program

Key topics

- Goals, content, conceptual and methodological basis of financial reporting with IFRS.

- Types of assessments. Discounted value.

- Formation of the accounting policy of the company.

- Assets. Reserves, contingent liabilities.

- Financial instruments. Rent.

- Recognition of income and expenses. Statement of Cash Flows.

- Forms of investments in other companies. Mergers and consolidated financial statements.

- Special topics of financial reporting.

- Industry standards of financial reporting.

Skills

- Understanding the structure, key definitions, and concepts of IFRS. Content and components of financial reporting.

- Possession of theoretical data, which are used while preparing financial statements by IFRS.

- Solving practical problems. Ability to make calculations for the purpose of IFRS and show them in financial statements.

- Submission of financial statements and disclosure of additional information.

Key topics

- The nature of management accounting. Classification of costs for decision-making.

- Cost management concept. Cost calculation methods. Break-even point.

- Managerial format of the profit and loss statement.

- Cost-based pricing.

- Budgeting. Responsibility centers.

- Financial control and its tools.

- Segment reporting. Management control.

- Development of the management control system: a balanced system of activity indicators.

Skills

- Setting up a management accounting and budgeting system.

- Management of financial resources and costs.

- Application of cost accounting methods, cost calculation, and pricing for management decision-making.

- Understanding the goals and tasks of budgeting in the company.

- Development of the company's financial structure and budget model.

- Formation, optimization, and control of the company's financial results.

Key topics

- Concept of an internal control system.

- Regulation of internal audit.

- Toolkit of the internal auditor.

- Audit evidence.

- Identification and management of risks in the internal audit system.

- Stages of internal audit.

- Fraud.

Skills

- Understanding the basics of internal audit.

- Application of internal audit standards and tools.

- Implementation of an effective system of internal control of the company.

- Creating an internal audit plan and program.

- Conducting inspections. Formation of the audit report.

Module 1. Introduction to Risk Management and Its Role in Modern Business

- Concept of risk: definition, classification, and components

- Importance of risk management culture in an organisation

- The role of risk management in strategic management

- International risk management standards (ISO 31000, COSO) and their application

Module 2. Identification and Classification of Risks

- Types of risks: external and internal (operational, financial, legal, cyber, reputational, etc.)

- Risk identification methods: environmental analysis, expert evaluations, SWOT, checklists

- Risk documentation: risk register

Module 3. Risk Assessment and Prioritisation

- Qualitative risk analysis: probability and impact scales

- Quantitative risk analysis: expected monetary value (EMV) method, sensitivity analysis, bow-tie method, Ishikawa diagram

- Decision tree analysis and scenario approach

- Developing a risk map and ranking by criticality

- Practical task: creation of a risk map and case study analysis

Module 4. Development of Risk Response Strategies

- Risk Response Planning: risk management strategies — avoidance, reduction (mitigation), transfer, acceptance

- Development of response plans for key risks

- Assigning responsibilities and resources using the RACI matrix

- Practical task: creation of a risk response plan for a selected case, modelling possible scenarios

Module 5. Implementation of a Risk Management System in a Company

- Architecture of the risk management system in business processes

- Integration of risk management into the company’s strategy

- KPI and Risk Tracking Methodology (RTM)

- Organisation of risk monitoring and control processes

- Practical task: development of a structure for implementing risk management

Module 6. Risk Management Technologies and Tools

- Overview of modern IT solutions for risk management

- Use of automation and AI in risk detection and control

- Detection of anomalies and fraud using antifraud systems

- Practical task: analysis of market tools

Module 7. Developing a Risk Management Culture in a Company

- Organising seminars and workshops on risk issues

- Communicating risk management results to colleagues and top management

- Critical analysis of the effectiveness of implemented measures

- Methods for assessing effectiveness: After Action Review, Root Cause Analysis, Gap Analysis, Lessons Learned Review

- Audit & Evaluation: KPI-based assessment, Post-Mortem analysis, Self-Assessment, feedback

- Strategies for improving the maturity of the risk management system

- Practical task: conducting an internal training (simulation) and preparing a risk management status report for the organisation

Module 8. Final Test

Skills after completing the program

After completing the "ACPM: Professional financial director" program, the candidate has the following knowledge and skills:

- Orientation in the requirements of international standards. Free use of IFRS terminology.

- Performing calculations for the purposes of IFRS and reflecting them in financial statements.

- Submission of financial statements and disclosure of additional information.

- Application of internal audit tools to protect the company from risks.

- Implementation of an effective system of internal control of the company.

- Conducting internal audits and generating reports.

- Optimization of risk management, control, and corporate management processes.

- Creation of a management accounting and budgeting system.

- Management of the company's financial resources and expenses.

- Development of the company's financial structure and budget model.

- Formation, optimization, and control of the company's financial results.

- Development and implementation of effective risk management strategies, identification, and mitigation of potential financial risks, and ensuring the company's resilience in dynamic environments.

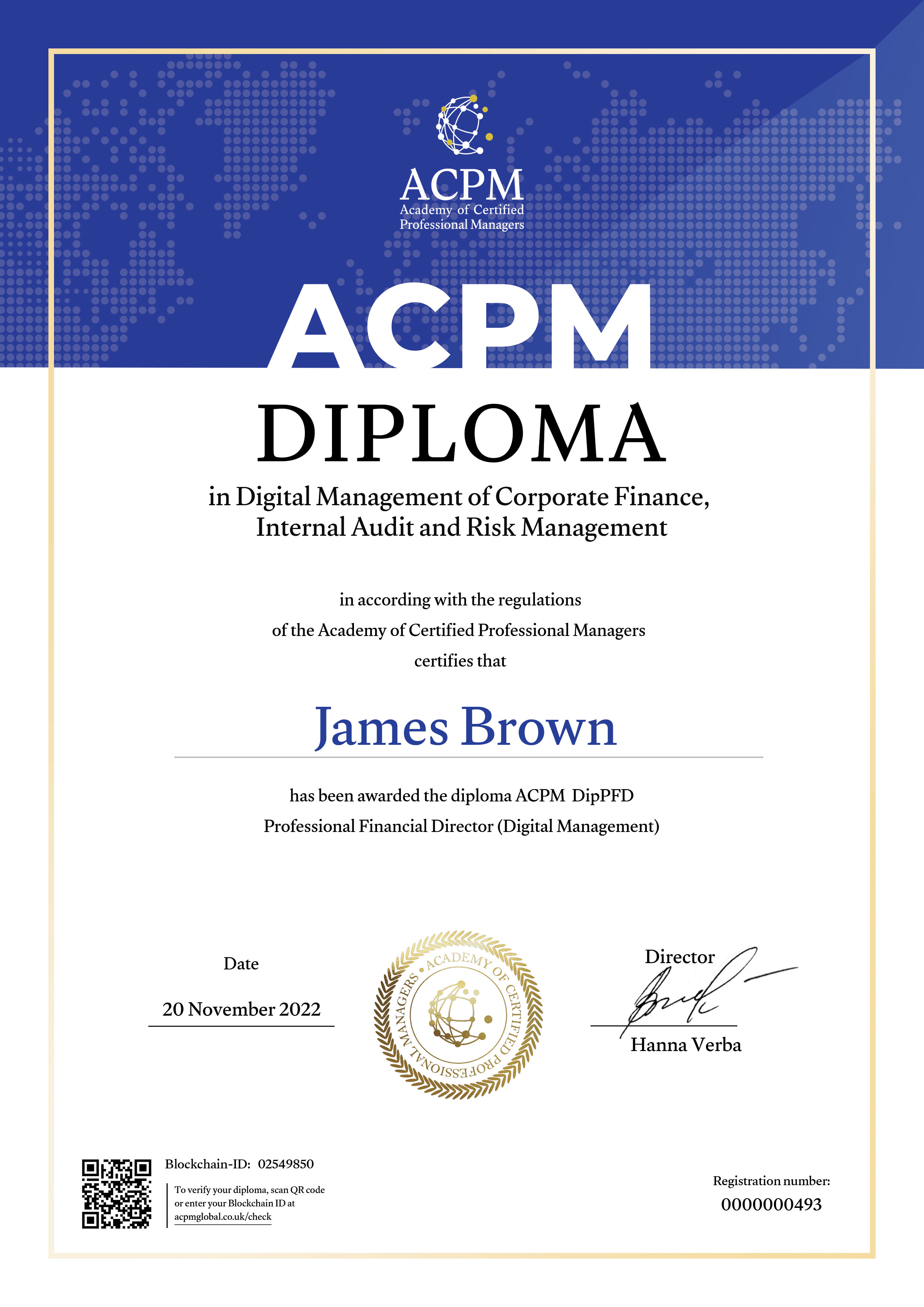

Exam and diploma

Knowledge is tested by three online exams for each part of the program: "ACPM: IFRS", "ACPM: Management accounting" and "ACPM: Internal audit". Exams are held every month according to the schedule. Registration is required to participate in each exam.

The exam consists of a test and a practical part (except "ACPM: Internal audit"). The total duration of the exam is from 2 to 3.5 hours (depending on the program).

The passing score is 60 (maximum score - 100 points).

The exam is conducted by administrators, and the completed assignments are checked and graded by ACPM-accredited instructors.

Each exam result is sent by email after 2-3 weeks. If a passing score is 60 or above, the ACPM International Diploma is sent electronically with the results.

After receiving diplomas in the IFRS, Management accounting, and Internal audit programs, the candidate automatically receives the diploma of a professional financial director "ACPM: Professional financial director".

Request the syllabus